Von John Hardy, Head of FX Strategys der Saxo Bank. Folgende Analyse erscheint auf finanzmarktwelt.de mit freundlicher Genehmigung des Autors. Den Originalartikel finden Sie hier.

Traders of EURUSD and other euro pairs are taking a second look at last week’s European Central Bank transcript and deciding that the ECB president Mario Draghi made a rather large move after all, it seems. The sharp rally off the lows near 1.3500 last Thursday was, in part, likely to have been driven by nervous spot trading by those with large short-date options positions, as I discussed on Friday.

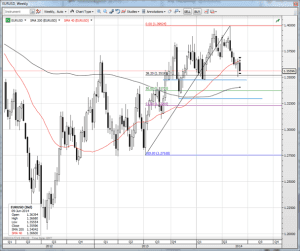

Now, as the dust has settled, it appears that euro bears are satisfied they still have a case. The important 1.3650+ and 200-day moving average resistance remained in place after a test post-ECB. And now it looks like the 1.3500 area looks will soon be under attack again. Those big round levels can often serve as magnets for considerable periods in EURUSD, particularly during a time of very low volatility. But let’s consider where the pair might head next if the 1.3500 level falls.

1.3475 – to be fair, this is the actual area of the 2014 low.

1.3300 – the next flatline support area of interest although I’m not satisfied it has much significance.

1.3250 – many think in quarters rather than round figures per se. Also, 1.3244 is the 38.2 percent Fibonacci of the entire bull market from the 2012 low at 1.2024 to the high this year just short of 1.4000.

1.3227 – 61.8 percent retracement of the wave from the massively important 1.2750 support zone.

1.3000 – the most magnetic of all magnetic big round numbers in EURUSD’s modern history.

1.2750 – a monster support level that is far, far away, but it is the tripwire for a true bear market that might eventually run towards 1.2000.

To me, the next big area of interest if we take out 1.3500 is the 1.3250/25 zone with all of its interesting Fibo implications and then the big 1.3000 level. Tactically speaking, we now have resistance moving down to the 1.3575/85 area with today’s action.

Chart: EURUSD hourly

Traders should also look at the hourly chart and note that the 1.3575/85 area was rather important before the circus that unfolded around the ECB meeting.

Kommentare lesen und schreiben, hier klicken