FMW-Redaktion

Die russische Zentralbank belässt ihren Leitzins auch heute in der 6. Sitzung nacheinander unverändert bei 11%. Wie auch vorher bleibt der Hauptgrund hierfür: Die Angst von Zentralbank vor einer steigenden Inflation. Liebend gerne würde Wladimir Putin wohl deutlich niedrigere Zinsen sehen um die Konjunktur zu unterstützen, aber anscheinend ist die Zentralbank in ihrer Entscheidung doch tatsächlich unabhängig. Die Inflation komme zwar zurück, aber das Risiko sei immer noch zu hoch, dass sie bei sinkenden Zinsen rasch wieder ansteige, so die Kernbotschaft der heutigen Entscheidung. Die Inflation in Russland sollte in genau einem Jahr bei 4% liegen, und Ende 2017 bei 4%, so die Zentralbank heute.

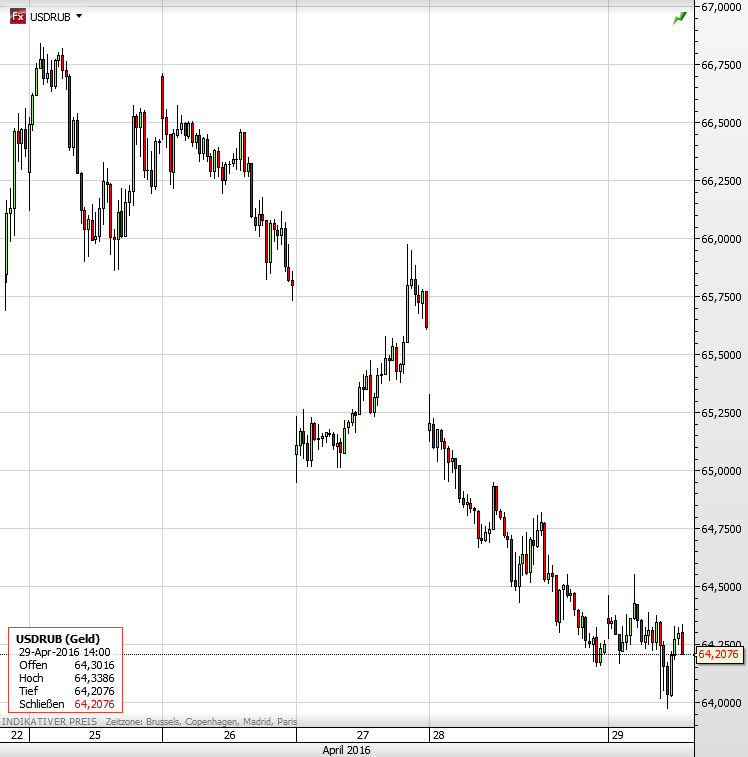

Die Devisentrader hatten die unveränderten 11% erwartet, von daher ist der Rubel-Kurs in den letzten zwei Stunden relativ unverändert geblieben. Seit Montag bewegt sich der Rubel wie alles, was gegen den Dollar gehandelt wird. Es geht nach oben. Für einen Dollar bezahlte man am Montag noch 66,80 Rubel, jetzt nur noch 64,20 Rubel.

Der US-Dollar fällt gegenüber dem Rubel.

Im Detail hier die Zentralbank im Original:

–

–

First. Inflation fell perceptibly; however, the trend bears risks of instability. Slower consumer price growth is triggered by weak demand and gradually descending inflation expectations, driven by, inter alia, the moderately tight monetary policy. Meanwhile, the factors, which are likely to have a temporary impact, have also made a considerable contribution to inflation reduction. They include the Government’s decisions on indexation of wages, pensions, administrated prices and tariffs, as well as a drop in global food prices.

Under the Bank of Russia estimates, the annual consumer price growth rate is down to 7.3% as of 25 April 2016 / as of 25 April 2016 remained at the level of March 2016 of 7.3%. This is in line with the inflation forecast for the year ahead, which the Bank of Russia published in its April 2015 press release (below 8%). In mid-2016, the annual consumer price growth is likely to accelerate temporarily owing to the low-base effect of the previous year. However, further on inflation will continue to go down. The Bank of Russia predicts, consistent with the decision, the annual inflation to stand at about 5% in April 2017, to reach the 4% target in late 2017.

Second. Key macroeconomic indicators show higher resistance of the Russian economy to fluctuations in oil prices. The floating exchange rate partially sets off the negative impact of external shocks. The development of import substitution and expansion of non-commodity exports make a positive contribution to industrial production dynamics. Capacity utilisation indicators have improved. The on-going shifts in the economy anticipate the beginning of its recovery growth. Quarterly GDP growth is expected to reach positive territory in 2016 H2 — early 2017.

Third. Interest rates in the economy are set to decline further even with the key rate unchanged. This is mainly driven by the planned Reserve Fund spending to finance the budget deficit and the ensuing changeover in the banking sector to a liquidity surplus.

Fourth. There remain elevated inflation risks. These primarily stem from slowly declining inflation expectations against the inflation target, mixed data on movements being observed in nominal wages, uncertainty in parameters of further wages and pensions indexation, and from the absence of mid-term budget consolidation strategy. Due to the continued supply glut in the oil market, the risks of crude prices dropping and their negative pressure on exchange rate and inflation expectations remain high enough.

Moving forward, should inflation risks fall as much as to ensure with greater certainty that the Bank of Russia achieves its inflation target, the Bank of Russia will resume a gradual lowering of its key rate at one of its forthcoming Board meetings.

The Bank of Russia Board of Directors will hold its next rate review meeting on 10 June 2016. The press release on the Bank of Russia Board decision is to be published at 13:30, Moscow time.

Kommentare lesen und schreiben, hier klicken