By Stefan Kasper-Behrs For three years the Swiss National bank avoided, by means of massive interventions at the currencies market, a revaluation of the Swiss Franc. On January 15th, 2015 this policy ended sending seismic waves around global financial markets. The Euro, for example, lost up to 30% of its trading value within a few minutes. Swiss equities freefell. Tens of thousands of investors lost their entire portfolios because they had trusted the assurances of the SNB. What did really happen on January 15th? The Swiss Franc 1.20 Scandal – new Background Information.

Guards of the Swiss Franc: The Board of the Swiss National Bank. Foto: Swiss National Bank

Avoiding the Revaluation of the Swiss Franc

What is it all about? Switzerland is famed as the financial sanctuary. More and more investors bought into securities during the so called Greek Crisis or Euro Crisis by exchanging Euros and other currencies into Swiss Franc, as both the country and its currency are famed for being safe. The dramatic result of this understandable ripple effect: The Swiss Franc got stronger and stronger versus Euro, Pound and US Dollar. This trend lead to two problems. First: The Swiss industries lost competitiveness in tourism, agriculture, and others. Tourists come from surrounding countries and have to exchange their currencies (Euro) into Swiss Franc to purchase beverages, ski vouchers, and visits to restaurants. Due to the ever increasing exchange rate, their Euros bought less and less Swiss Franc. Their vacations became more expensive, the tourism numbers dwindled. Second: Switzerland has a remarkable and important exporting manufacturing industry. Foreign customers have to pay for their goods in Swiss Franc and those products get more and more expensive. Would they pay in Euros, for example, the Swiss exporter has to cover the exchange into Swiss Franc and obtains less for his products. Therefore the rising exchange rate of the Swiss Franc became a growing problem for the Swiss economy.

“Freezing” the Swiss Franc at 1.20

The SNB created the idea to “freeze” the exchange rate at 1.20 Swiss Franc per Euro. As all currencies are traded freely between banks the SNB had to virtually “print” amounts of Swiss Franc to buy Euros incase speculators would try to push the exchange rate below the mark of 1.20. The SNB purchased significant amounts of Euros using “printed” Swiss Franc over the past years. The Result: Foreign exchange currency reserves increased significantly and reached the mark of 500 Billion Swiss Franc. The SNB promised repeatedly and publicly (Video Press Conference) to continue its policy of supporting the 1.20 threshold (repeatedly mentioned as close as three days prior to its cancellation) even though they also stated that this policy was not made for eternity.

Here an Interview with the President of the SNB shortly before the Cancellation of the 1,20 Threshold. Funds managers, private investors, and speculators trusted this promise as they were trying to benefit from the Swiss Franc/Euro 1.20 threshold. Many investors still counted on the possibility of the SNB giving up their support and placed stop orders, despite the fact, that those stop orders might not all be fulfilled incase of a massive sell-off after the SNB cancelling their support.

Swiss Franc in Freefall

To most everyone’s surprise the SNB terminated its support for a 1.20 exchange rate on January 15th, 2015. A disaster for all of those who relied on the quote of SNB´s President Thomas J. Jordan (link3). This surprising announcement was emitted not on a weekend, but on a regular trading day during business hours. It had devastating results and financially ruined many customers of brokers and asset managers.

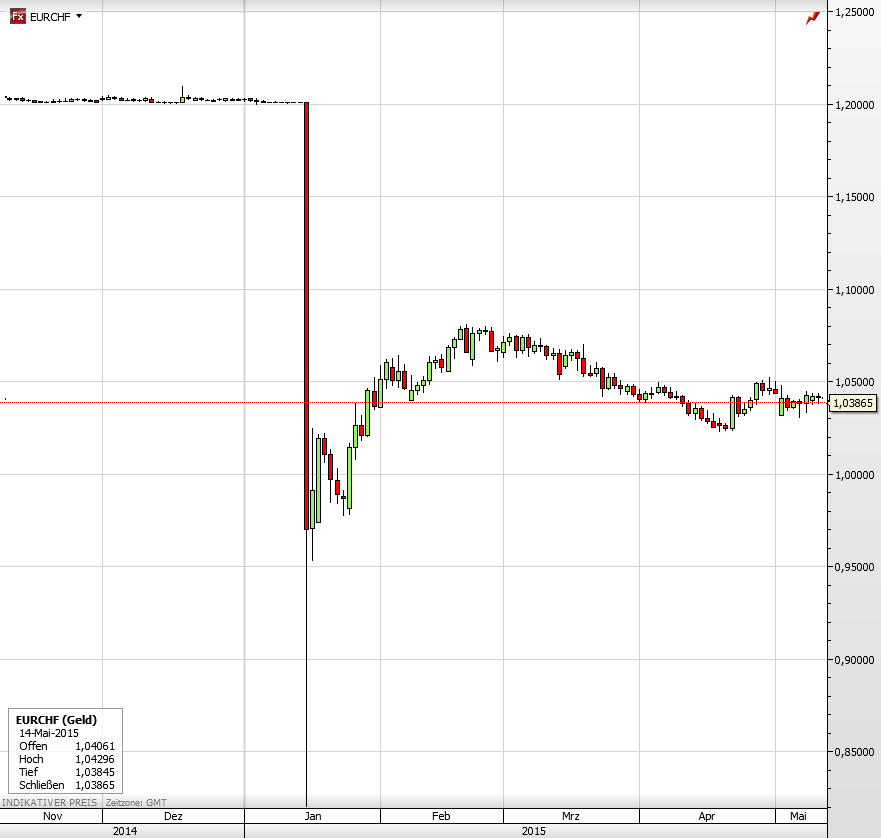

This charts shows the price of Euro vs. Swiss Franc from December 2014 to May 2015, clearly shows the 1.20 threshold enforced by the SNB. Only minutes after publishing the SNB decision, the price dropped from 1.20 to 0.97 at the end of the day. A debacle for tens of thousands of Investors. The blame was put on bankers and brokers. A flock of lawyers who emerged as “specialists” in currency trading, disagreed the broker´s/bank´s requests against their clients who (after losing their complete balance) should make additional payments to the bank/broker. They might be successful when suing brokers and banks. Hardly any of those law firms focused on the real culprit, but suggested their clients come to terms with their debtors.

Negligence and Fraud?

From our point of view the SNB is not without guilt! Not because the SNB dropped the 1.20 threshold (Euro vs. Swiss Franc) as it is their duty as both a national bank as well as a publicly traded entity looking after the interests of state and investors. We are criticizing the when and how of their actions. One could assume that the SNB was misleading, but it would make little sense to pursue the matter legally. I have personally exchanged phone calls and emails with nice people at SNB throughout the last months and weeks of my research. I found details that almost seem incredible. Let’s review those item-by-item.

January 15th, 2015, 10:30h The SNB sends out emails at precisely 10:30 a.m. stating that the exchange rate support has been cancelled. I have checked my inbox and found that I have not received a SNB email. I, therefore, called the SNB and asked who had received these notifications. SNB’s ANSWER:

“Only the media on our mailing list have received our 10:30 a.m. communication,. It has not been sent to banks or other financial service providers.”

Not I ask to what media the email was sent to: SNB’s ANSWER:

“We do not want to send you a list of recipients of that email.”

Why would the SNB not give me the list of recipients? Who was inside the circle to receive this desirable message? I decided to do the job myself and find out when the major media had released the message.

Bloomberg 10:31:35

Reuters after 10:34

dpa-AFX after 10:34

Neue Zuericher Zeitung 11:40 h

According to my research the fastest agency was Bloomberg, they were able to publicize the news 1minutes 35 seconds after receipt. Professional traders in banks use Bloomberg or Reuters as rates and news providers. At Reuters, the person in charge overlooked the SNB email. Upon my request Reuters told me that they were “pretty shocked” that this had happened. Unfortunately, this mail account receives a thousand emails per day, this important SNB communication was simply missed. That is why Reuters published the message approximately 3 minutes after Bloomberg. Not a good mark for Reuters. Neither Reuters nor Bloomberg wanted to send me a copy of the email!

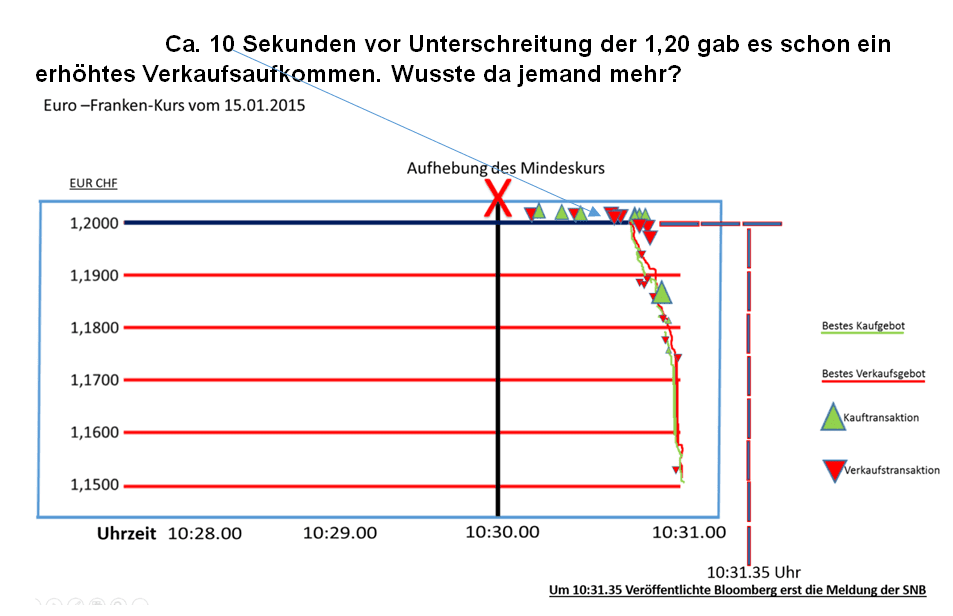

January 15th, 2015, 10:34:45 a.m. Let us look at a graph, the data is provided by the SNB and can be downloaded at the end of this report.

Approx. 10 seconds before breaking the 1.20 threshold there is an increased sale activity. Did someone know what was about to happen? We can assume that Bloomberg was one of the fastest media companies in breaking the SNB news. Only 50 seconds after passing the 1.20 threshold, a lot of time in currency trading, Bloomberg spread the news. But already 30 seconds after 10:30 a.m. selling orders kept piling up. The SNB states to have emailed approximately 200 companies on their mailing list at precisely 10:30. The rate dropped below 1.20 for the first time at exactly 10:30:45 am. The SNB was very active in currency trading during previous years to provide exchange rate support. The important question now is … when did the SNB order their associated banks to stop buying at 1.20? Even if the order not to buy at 1.20 was given parallel to the email, one might suspect an advantage given to the associated banks. It is not known what banks processed SNB Swiss Franc buy orders, but one can reasonably assume that it was with the major Swiss banks. These banks assumedly have traders dedicated to the SNB.

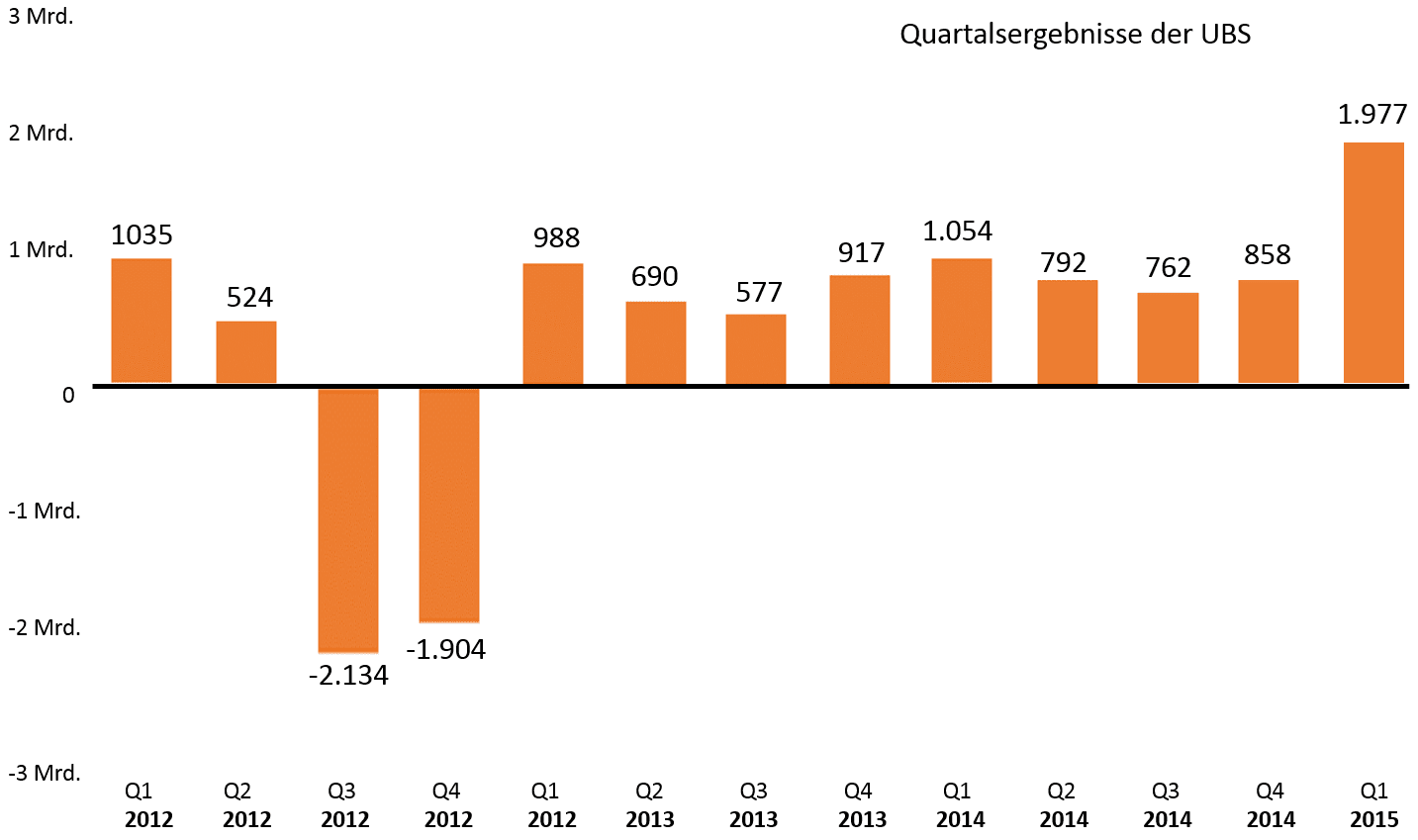

Those traders would be the first ones to see the cancelled rate support. This advantage was probably worth “its weight in gold”. A few Facts: Deutsche Bank lost approx. 130 million Euro due to the currency market earthquake on January 15th, 2015. Citigroup lost a similar amount, Saxobank lost more than 100 Million US$. British CFD and Forex trader Alpari UK filed for bankruptcy. FXCM survived thanks to an injection of 300 Million US$. The British major bank Barclays is said to have suffered important losses. The list of banks and brokers suffering from losses is almost endless. Based on an estimate by Towers Watson consultants, 30 Billion Swiss Franc in pensions have been obliterated. My request to UBS inquiring about trading losses was answered with the following email: Dear Mr. Kasper-Behrs, Unfortunately, we do not publish the information requested by you. Thank you for your understanding. Best Regards. Credit Suisse answered along those lines. Due to the lack of information, I had to wait for the quarterly reports of some banks. UBS has ended first quarter of 2015 significantly better than expected and has thus surprised all analysts. A quarterly result of +1.977 Billion Swiss Franc was achieved.

In Comparison, the bank (UBS) has produced 1 Billion Swiss Franc less in each first quarters of the years 2012 to 2015. The previous three quarters produced over 1 Billion Swiss Franc less compared to the first quarter of 2015. Analyzing the report further one could find that UBS increased their profits from FX, rates and credit, by a surprising 71%. Evil to him who thinks evil of it!

Why announce the news during active trading?

Why wasn’t the abandonment of the exchange rate support communicated on Saturday, January 17th, 2015? If so, all would have had an equal opportunity in the market. The US releases market info outside of trading times. The SNB board knew that the EZB (pursuant to a verdict by the European Council (EGH) dated January 14, 2015) (LINK 4) was able to purchase government bonds. The board expected that to happen shortly. The SNB seemed to have feared to have to engage into even more interventions to be able to maintain the 1.20 exchange rate. And evidently, on January 22nd, 2015, EZB’s Mario Draghi announced the purchase of government bonds valued at hundreds of billions Euro. The purchase of this value could not have been decided by the ECB in a matter of one week! This decision, as well as the date for publicizing the decision, have surely been determined before. It was known that the EGH would announce its verdict on January 14th, 2015. It is plausible that Mr. Jordan spoke with Mr. Draghi beforehand. He learned that one week after the EGH verdict that the EZB had planned to purchase European goverment bonds of incredible value. It could very well be that Mr. Jordan knew about those plans. Possibly, the SNB had planned to abandon the support of the Swiss Franc at 1.20 incase of a positive verdict much earlier. That would mean, however, that SNB’s vows of January 13th, 2015 (to maintain the exchange rate at 1.20) have mislead their citizens, investors, and banks. Mr. Jordan gave the following statement. “The timing of our decision is not related to the EGH verdict, that was a coincidence.”

A Clean Cut

The SNB wants to project the impression that the decision to end the support had been made in haste. I cannot believe that completely. A case of negligence and fraud? Or even worse? That is according to the individual observer of the situation on January 15th. It is a fact though that tens of thousands of investors around the world have lost a whole lot of money due to this specific situation in the Swiss Franc, both in equity/stock and currencies. Publishing the decision on a Saturday, with closed markets worldwide, would have been fair and transparent for all involved. Now we have brokers and clients fighting over whose Stop came when, why and how late or why it did not work at all.

Objectivity instead of Panic?

This is my opinion: Had the decision to end the 1.20 support have been communicated on a Saturday, the objectivity of the market on Monday, based on the time distance would have been much better. What do I mean by that? In the past 15 years of stock trading we have come across events that pummeled the trading community considerably. It was PANIC more than the event itself that lead to worldwide stock exchange crashes. The human psychology always responds with PANIC to those events. It overreacts. If there would have been two additional weekend days to stomach the disappearance of the threshold, the drop would not have been as brutal as it was – instead of a decrease from 1.20 to 0.97, maybe the rate would only have reached 1.05 o5 1.10. The damage for all involved would have been less if there would have been time to prepare. Especially funds and banks would have been able to consult and prepare for the situation-at-hand. But, maybe only a small circle was involved on purpose? We shall not forget that the wife of the predecessor of today’s SNB boss had conducted FX transactions in August of 2011 (US$ – Swiss Franc Exchange). Only due to pressure from the public media, the SNB announced on January 12th, 2012 the immediate resignation of it’s boss Mr. Hildebrand. We learned about those transactions only because of data stolen from (their) bank, Bank Sarasin, that were made public. In January of 2012, the SNB committee had an audit of their accounts conducted only to conclude that no infraction had been committed. She must have just been a great trader! The public learned on May 20th, 2015 that an ECB director had made statements during a reception in London on May 18th, 2015 about ECB’s plan to increase their bonds purchases in summer due to reduced liquidity in that period. The attending other bankers might have, allegedly, benefited from this information right then. The rest of the market members only learned about this plan the following morning. These events make me think about the FIFA somehow, I wouldn’t know why … ?

A Lawyer’s Opinion

These two previous examples are, of course, in no way related to the “Swiss Franc Subject” of January 15th, 2015, but do show that national banks do not always behave a serious and proper as one might think.What legal options might an investor have? I have discussed this subject with renown bank law expert and lawyer, Prof. Dr. Klaus F. Broeker. He has asked me to clearly state that the following is merely a quick synopsis and far from an official expert report. It is based solely on my input without verifying if complete, accurate, and in its entirety. It reflects his current legal opinion and does not include any warranty as to its correctness or completeness. He is voicing an opinion. Remarks about a possible liability of SNB in conjunction with the events on January 15th, 2015 (Swiss Franc) by Prof Dr. Broeker:

SNB as a possible defendant? 1) Based on possible infringement of contractual obligation: Claimants may only be such entireties that have a direct contractual relationship with SNB, as only an infringement of a right stemming from such contract may result in a liability of SNB. If SNB is acting like a common law entity and even into a contract as such common law entity (as opposed to a public entity), then basically there is a ground for a liability claim against SNB. The requirements for such claim in an overview: Contract SNB acting as common law entity Breach of contractual obligation by SNB Causality between breach of contract and damages Cause to protect contractual partner Conclusion: Breach of such contractual obligations seems unlikely. Possibly claimants may be corporations or persons suffering from financial losses due to the January 15th, 2015 events. It is questionable if there were individual or numerous acts by SNB or one of its employees/board members related to the abandonment of the Euro support that are cause for liability. Only then could these result in indemnifications. Changes in FX policies or the abandonment of the Euro support despite of opposing previous declarations are not suitable to support the claim.

It is, after all, the duty of the national bank to monitor the markets constantly and to make corresponding decisions concerning monetary stability. In case of SNB or one of their employees giving privileged preferential information to certain market members, for example, about no longer supporting the 1.20 exchange rate, that might possibly be legally problematic. Abandoning the Euro support during regular trading hours might be a possible cause for legal investigation. Such an announcement outside of regular trading hours could have caused less of a market aggravation. All market members would have had the same level of information at opening markets. One could think of regarding this analogy to an “Ad hoc” announcement according to Par. 15 Abs. 1, WpHG. This rule calls for immediate release of such important information if it does not cause misinformation of the public, not being the case here. Furthermore, these regulations are irrelevant in accordance with Par.1 Abs. 3, WpHG. In theory, it might be possible that there were certain activities causing suspicion of a market manipulation according to Par. 20 a, WpHG. Per Par. 20a Abs 4 No. 3, WpHG foreign currencies are regarded as objects that fall under the regulations of Par. 20a, WpHG. On the other hand, regulations according to Par.1 Abs. 3, WpHG apply. Where an intervention by national banks in favor of certain currencies made due to monetary policies are exempt of Par. 20 a, WpHG. The SNB will use the above reasoning and is therefore exempt. As long as there is no court relevant evidence of an intentional act with self-enriching components against protective regulations, no liability claims can be made. Evident of such kind could only be internal email exchange or written remarks of SNB employees with third parties. This seems to be farfetched. In conclusion: Based on current information civil claims again SNB regarding the events from January 15th, 2015 do not seem feasible.

Whistleblower

Only a Whistleblower could possibly unearth a preferential treatment by SNB of corporations, banks, or individuals. Such information, if existing at all, could become pretty expensive for SNB. Dear Whistle Blower, send us your message at:

– –

In closing, I would like to use this quote: An imposter is someone who scams others without having the legal right to do so!

© Prof. Querulix (*1946), german deutscher aphorist and satirist. – – –

Download of SNB Data.

– –

Remark: Mr. Broeker´s Comments for the possible accountability of the SNB are no legal advice.

Kommentare lesen und schreiben, hier klicken