General Electric und Boeing haben soeben ihre Quartalszahlen veröffentlicht. Auch wenn GE nicht mehr im Dow 30 enthalten ist, so ist man doch immer noch ein gigantisch großer Industriekonzern! Teilweise ist man Profiteur der Coronakrise (Gesundheitssparte), teilweise leidet man auch darunter (Flugzeugzulieferer). Hier erstmal die Daten von GE.

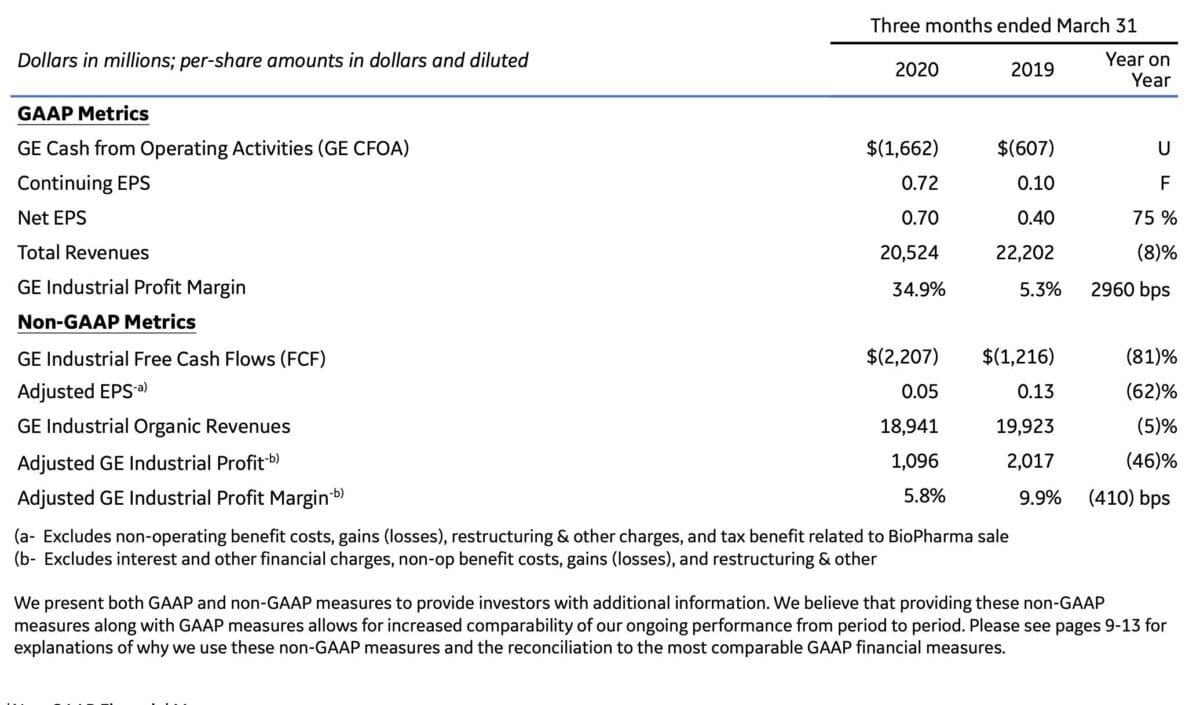

Der Umsatz liegt bei 20,52 Milliarden Dollar (Vorjahresquartal 22,2/erwartet 20,7).

Der Gewinn pro Aktie (Non Gaap) liegt bei 5 Cents (Vorjahresquartal 13 Cents/erwartet 6 Cents).

Die Aktie notiert vorbörslich mit -3 Prozent.

CEO-Kommentar im Wortlaut:

GE Chairman and CEO H. Lawrence Culp, Jr. said, “During this unprecedented pandemic, the GE team is focused on protecting the safety of our employees and communities, serving customers in their critical time of need, and preserving our strength for the long term. GE is delivering critical infrastructure and services across the globe, including our teams at Healthcare supporting caregivers who diagnose and treat COVID-19 patients every day.“

Culp continued, “The impact from COVID-19 materially challenged our first-quarter results, especially in Aviation, where we saw a dramatic decline in commercial aerospace as the virus spread globally in March. We are targeting more than $2 billion in operational cost out and $3 billion of cash preservation to mitigate the financial impact, and we executed a series of actions to de-risk and de-lever our balance sheet amid a challenging environment. While there are many unknowns, there will be another side—planes will fly again, healthcare will normalize and modernize, and the world still needs more efficient, resilient energy. We’re embracing today’s reality and accelerating our multi-year transformation to make GE a stronger, nimbler, and more valuable company.“

Boeing

Boeing hat nicht nur mit der Coronakrise zu kämpfen, sondern war vorher schon massiv unter Druck wegen den zwei Abstürzen der 737 Max, nicht mehr erlaubten Flügen und dem Produktionsstopp. Hier nun die Zahlen für das letzte Quartal.

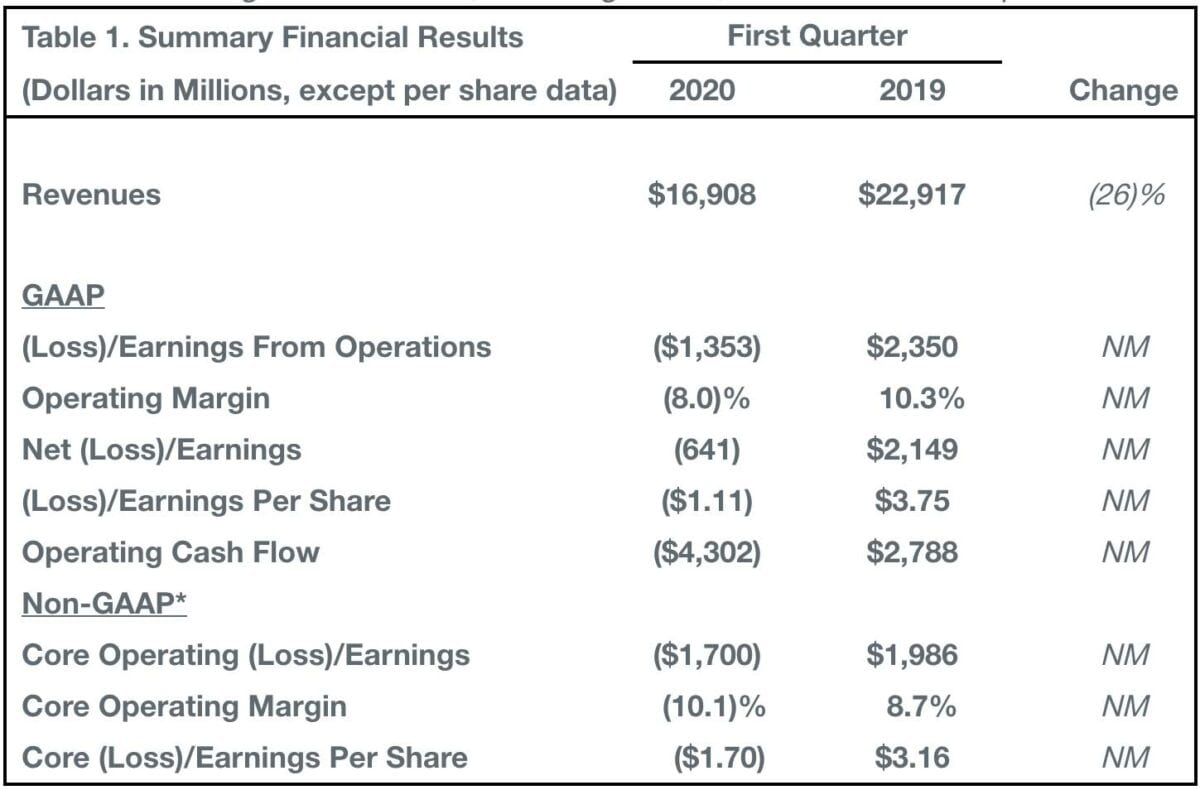

Der Umsatz liegt bei 16,91 Milliarden Dollar (Vorjahresquartal 22,92/erwartet 17,3).

Der Verlust (Non Gaap) pro Aktie liegt bei -1,70 Dollar (Vorjahresquartal +3,16/erwartet -1,61).

Die Aktie notiert vorbörslich mit +2,6 Prozent.

CEO-Kommentar auszugsweise im Wortlaut:

As the pandemic continues to reduce airline passenger traffic, Boeing sees significant impact on the demand for new commercial airplanes and services, with airlines delaying purchases for new jets, slowing delivery schedules and deferring elective maintenance. To align the business for the new market reality, Boeing is taking several actions that include reducing commercial airplane production rates. The company also announced a leadership and organizational restructuring to streamline roles and responsibilities, and plans to reduce overall staffing levels with a voluntary layoff program and additional workforce actions as necessary.

Boeing has also taken action to manage near-term liquidity, as it has drawn on a term loan facility; reduced operating costs and discretionary spending; extended the existing pause on share repurchases and suspended dividends until further notice; reduced or deferred research and development and capital expenditures; and eliminated CEO and Chairman pay for the year. Access to additional liquidity will be critical for Boeing and the aerospace manufacturing sector to bridge to recovery, and the company is actively exploring all of the available options. Boeing believes it will be able to obtain sufficient liquidity to fund its operations.

„While COVID-19 is adding unprecedented pressure to our business, we remain confident in our long term future,“ said Calhoun. „We continue to support our defense customers in their critical national security missions. We are progressing toward the safe return to service of the 737 MAX, and we are driving safety, quality and operational excellence into all that we do every day. Air travel has always been resilient, our portfolio of products and technology is well positioned, and we are confident we will emerge from the crisis and thrive again as a leader of our industry.“

Kommentare lesen und schreiben, hier klicken