FMW-Redaktion

Soeben wurden die Amazon-Quartalszahlen veröffentlicht.

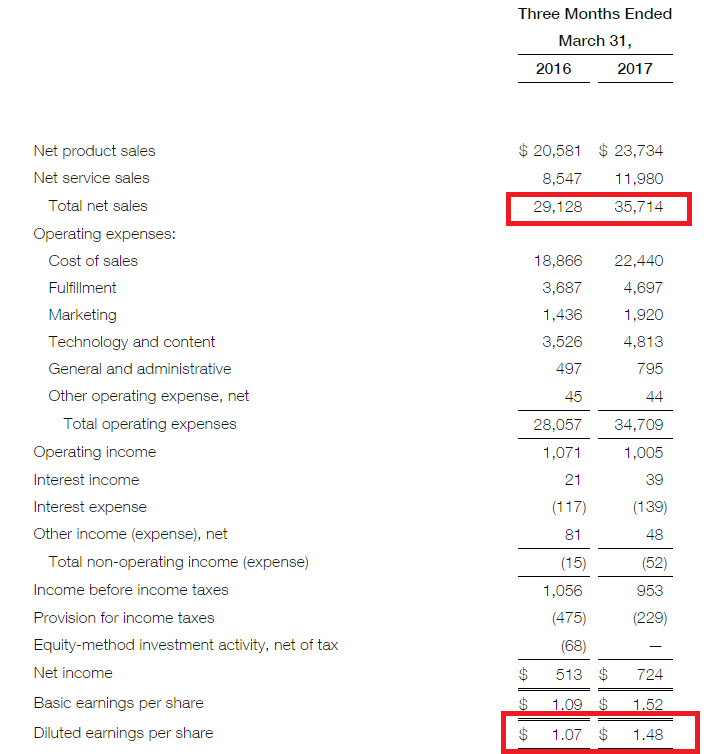

Der Umsatz liegt im 1. Quartal bei 35,7 Milliarden Dollar (erwartet ca 35 Milliarden Dollar / 29,1 Milliarden Dollar im Vorjahresquartal).

Der Gewinn liegt im 1. Quartal bei 1,48 Dollar pro Aktie (erwartet ca 1,15 Dollar / 1,07 Dollar im Vorjahresquartal).

Wichtig: Was hat das Segment „Amazon Web Services“ gemacht, das so wichtig ist, und letztes Quartal enttäuscht hatte? Der Umsatz steigt im Jahresvergleich von 2,5 auf 3,6 Milliarden Dollar, der Gewinnbeitrag von 604 auf 890 Millionen Dollar!

Der Ausblick: Im laufenden Quartal will man einen Umsatz von 35,25-37,75 Milliarden Dollar erzielen und somit bis zu 24% wachsen im Jahresvergleich.

Die Aktie notiert nachbörslich mit einem Plus von 4,2%.

Originalwortlaut heute zu den Web Services (AWS):

AWS announced Amazon Chime, a unified communications service that makes meetings easier and more efficient than ever before. Customers can start or join a meeting with a single click, and Amazon Chime delivers a frustration-free meeting experience with exceptional video and audio quality, chat, and screen sharing capabilities — all seamlessly synchronized across desktops, iOS, and Android devices.

AWS announced Amazon Connect, a cloud-based contact center service that is based on the same contact center technology used by Amazon customer service associates around the world to power millions of customer conversations.

AWS announced it will open an infrastructure region with three Availability Zones in Sweden in 2018. AWS currently operates 42 Availability Zones across 16 infrastructure regions worldwide, with another five Availability Zones across two AWS Regions in France and China expected to come online this year.

Recent AWS enterprise customer highlights include: Live Nation, the world’s leading live entertainment and ticketing company, announced it is going “all-in” on AWS; Dunkin’ Brands Group, Inc., the parent company of Dunkin’ Donuts and Baskin-Robbins, migrated their business-critical mobile applications, e-commerce websites, and key corporate IT infrastructure applications to AWS; HERE Technologies, a leading global provider of maps and location services, disclosed that AWS is its preferred cloud infrastructure provider and continues to expand its use of AWS to power its new Open Location Platform services; Liberty Mutual announced it is using AWS to speed implementation of a new state-of-the-art business platform to quickly bring new products and capabilities to their customers and operations; and Snap, Inc. expanded their use of AWS and announced a new, enterprise agreement to use $1 billion of AWS services over the next five years.

AWS launched Redshift Spectrum, a new feature of Amazon Redshift that allows customers to run queries on exabytes (1 exabyte = 1,000 petabytes) of data in Amazon S3 just as easily as they run queries against petabytes of data stored in their Amazon Redshift data warehouse. Redshift Spectrum uses the same SQL as Amazon Redshift and scales query processing across thousands of nodes to deliver fast results — even with large data sets and complex queries. For example, a complex query on an exabyte of data using 1,000 notes and the Hive Query Language would take five years. With Amazon Redshift Spectrum, the same query takes just 155 seconds.

AWS announced Amazon DynamoDB Accelerator (DAX), a fully-managed, highly available, in-memory cache that can reduce Amazon DynamoDB response times from milliseconds to microseconds, even at millions of requests per second. With DAX, customers using DynamoDB for mobile, web, gaming, ad tech, IoT, and many other types of applications can achieve 10x faster query performance.

AWS announced that customers have migrated more than 23,000 databases using the AWS Database Migration Service since it became generally available in 2016.

AWS announced the general availability of Amazon Lex, making the proven, highly scalable artificial intelligence (AI) technologies that power Amazon Alexa available to all developers. American Heart Association, Capital One, Freshdesk, Hubspot, Liberty Mutual, NASA, Ohio Health, and Vonage are among the customers using Amazon Lex to build rich, conversational user experiences for web, mobile, and connected device applications.

AWS continued to expand the breadth and depth of its Amazon Elastic Compute Cloud (EC2) offerings with the general availability of the next generation of its High I/O (I3) instances, and field programmable gate array (FPGA) accelerated (F1) instances.

AWS announced AWS CodeStar, a new tool that enables developers to quickly develop and run applications on AWS. CodeStar provides a single graphical interface where development teams can manage their software development activities from one place. With CodeStar, teams can easily start with one-click project templates, perform continuous delivery, manage read and write permissions of the team, and monitor application activity.

AWS collaborated with NASA to deliver the highest resolution video ever broadcast live from space (ultra-high-definition broadcast transmitted in 4K) during a keynote presentation at the 2017 National Association of Broadcasters Show in Las Vegas. The session featured NASA astronaut and Expedition 51 commander, Peggy Whitson, speaking live from the International Space Station 250 miles above the Earth, which travels at 17,500 miles per hour and orbits the planet 16 times per day. The session explored how advanced imaging and cloud technologies are taking scientific research and filmmaking to the next level.

Kommentare lesen und schreiben, hier klicken

Also dann Dow 50000

Mindestens!! Das reicht nicht.

tja das wars dann für die Bären – ab sofort für immer Bullenmarkt beim NDX – nächstes Ziel NDX 6000 – 2018 8000 und dann kommt auch die 10000 – heile Tech-Welt

Wäre noch zu erwähnen, dass die Aktie 920 US$ kostet, bei 1,45 US$ Quartalsgewinn (KGV annualsiert 160, PEG 4,6). Das muss der kommende Monopolistenbonus sein. Ach ja, ist schließlich ein Internetbusiness, da wird demnächst ohnehin wieder die steigende Cash-Burn-Rate bezahlt, wie bei Tesla oder Rocket Internet. Zu meinen Anfängen als Analyst galt alles jenseits PEG 1 als krass teuer. Aber da war die Welt ja noch nicht überschuldet und kranke Typen wie Trump galten noch nicht einmal in der New Yorker Partyszene als akzeptabel.