Die JP Morgan-Quartalszahlen wurden soeben veröffentlicht. Sie genießen immense Bedeutung, da JP Morgan die größte Bank der USA ist. Hier die wichtigsten Eckdaten.

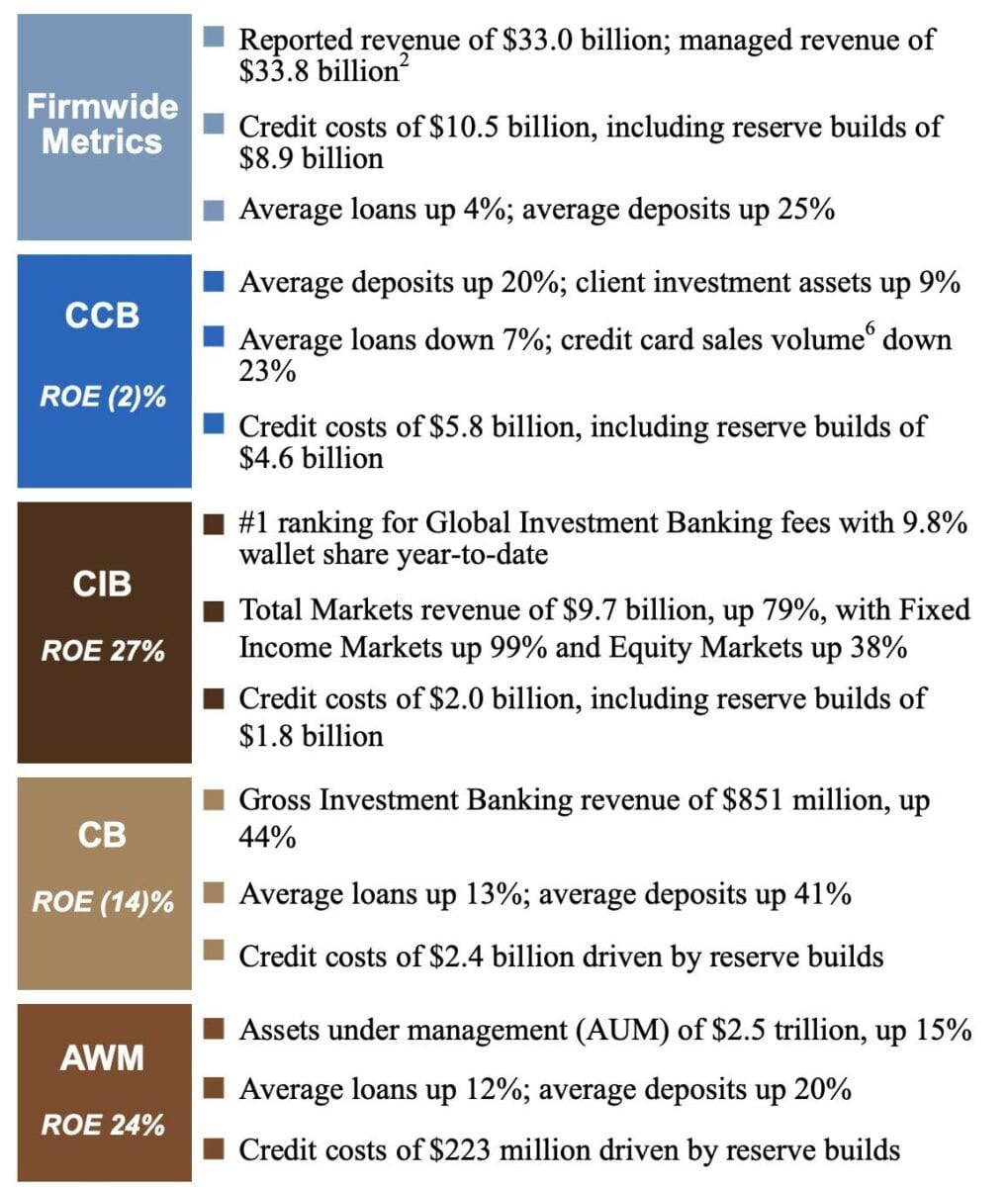

Der Erlös (Umsatz) liegt bei 33,0 Milliarden Dollar (Vorjahresquartal 29,57/erwartet 30,3). Der Gewinn pro Aktie liegt bei 1,38 Dollar pro Aktie (Vorjahresquartal 2,82/erwartet 1,04).

10,47 Milliarden Dollar wurden im zweiten Quartal für Kreditausfälle und mögliche Kreditausfälle insgesamt zurückgestellt (ca 9 Milliarden Dollar erwartet).

Die Aktie von JP Morgan notiert aktuell in der Vorbörse mit plus 2,5 Prozent. Ohhh Wunder, möchte man sagen – niedrige Erwartungen übertroffen, Aktie rauf!

Wollen Sie in die Tiefe einsteigen bei den Zahlen von JP Morgan? Klicken Sie hier für die aktuelle Präsentation der Bank mit interessanten Charts und Daten.

Hier die ganze Headline-Aussage vom mächtigsten Banker der USA Jamie Dimon im Wortlaut:

“I want to thank our employees around the world for their exceptional work under the most difficult of circumstances over the past several months. As one of the world’s largest financial institutions, our actions are critical to keep the global economy going – from processing $6 trillion in payments each day worldwide to keeping three-quarters of our nearly 5,000 branches open – and safe – to meet individuals’ financial needs. During these unprecedented times, JPMorgan Chase remains resilient and steadfast in using all of our resources to support our colleagues, clients and communities across the globe.”

Dimon added: “Despite some recent positive macroeconomic data and significant, decisive government action, we still face much uncertainty regarding the future path of the economy. However, we are prepared for all eventualities as our fortress balance sheet allows us to remain a port in the storm. We ended the quarter with massive lossabsorbing capacity – over $34 billion of credit reserves and total liquidity resources of $1.5 trillion, on top of $191 billion of CET1 capital, with significant earnings power that would allow us to absorb even more credit reserves if needed. This is why we can continue to serve all of our stakeholders and to pay our dividend – unless the economic situation deteriorates materially and significantly.”

Dimon commented on the results: “We earned $4.7 billion of net income in the second quarter despite building $8.9 billion of credit reserves because we generated our highest quarterly revenue ever, which demonstrates the benefit of our diversified global business model. Record Markets revenue (up 79%) and Investment Banking fees (up 54%) in the Corporate & Investment Bank more than offset interest rate headwinds and reduced consumer activity. In Consumer & Community Banking, deposits and client investment assets continued to grow (up 20% and 9%, respectively) as we addressed our customers’ needs remotely as well as in our branches. Card sales volumes are down but have been consistently trending upward since April. We remained active in Home Lending on the strength of our digital platform, and Auto originations picked up in the second half of the quarter driven by pent up demand in states that are re-opening. We maintained our #1 rank in Global IB fees and grew our year-to-date share to 9.8% with strength across the franchise, including in Commercial Banking. The CB also grew loans 13% to $234 billion and deposits were up 41% as we helped clients manage their liquidity needs. In Asset & Wealth Management, AUM grew 15% driven by $124 billion of net inflows into liquidity and long-term products as we helped clients navigate market volatility.”

Dimon concluded: “We are fully committed to doing our part both in promoting the safety of our employees and customers and helping the economies of the world recover from the impact of the ongoing COVID-19 crisis, including helping to drive policies and programs for the benefit of all of society and create opportunity for those who have been left out of the economy for far too long.”

Karrikatur von Jamie Dimon, dem „USA-Banker“, dem Chef der wichtigsten und mächtigsten Bank der USA, der JP Morgan zu einer sprudelnden Geldquelle machte. Urheber: DonkeyHotey CC BY-SA 2.0

Kommentare lesen und schreiben, hier klicken

Wer’s glaubt wird selig :D

Wenn so „gute“ Daten veröffentlicht werden, kann man davon ausgehen, dass die Bank kurz vor der Pleite steht.