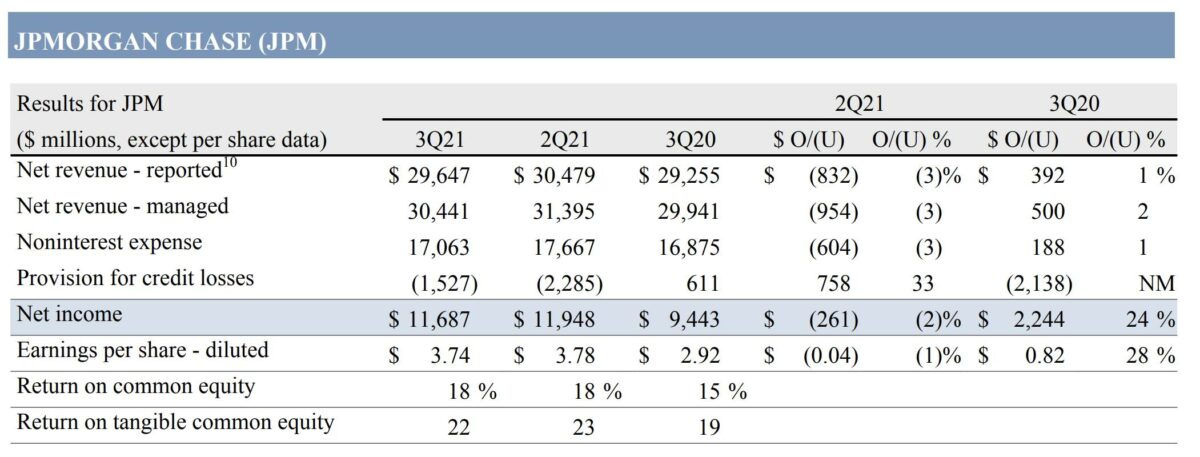

Die JP Morgan-Quartalszahlen wurden soeben veröffentlicht. Sie genießen immense Bedeutung, da JPM die größte Bank der USA ist. Hier die wichtigsten Eckdaten. Der Erlös (Umsatz) liegt bei 30,44 Milliarden Dollar (Vorjahresquartal 29,94/erwartet 29,76). Der Gewinn pro Aktie liegt bei 3,74 Dollar pro Aktie (Vorjahresquartal 2,92/erwartet 3,00). JP Morgan liegt bei Erlös und Gewinn somit über dem Vorjahr und über den Erwartungen!

Man hat Kreditreserven in Höhe von 2,1 Milliarden Dollar aufgelöst, da sich die wirtschaftlichen Aussichten weiter verbessern und unsere Szenarien sich entsprechend verbessert haben, so die Bank in ihrem Bericht.

Die Aktie von JP Morgan notiert aktuell in der Vorbörse mit +0,27 Prozent.

Original-Kommentar von JP Morgan-Chef Jamie Dimon:

Jamie Dimon, Chairman and CEO, commented on the financial results: “JPMorgan Chase delivered strong results as the economy continues to show good growth – despite the dampening effect of the Delta variant and supply chain disruptions. We released credit reserves of $2.1 billion, as the economic outlook continues to improve and our scenarios have improved accordingly. As we have said before, however, we do not consider these scenario-driven releases core or recurring profits. These reserve calculations, while done extremely diligently and carefully, involve multiple, multi-year hypothetical probability-adjusted scenarios, which may or may not occur and which may continue to introduce quarterly volatility in our reserves. Our earnings, not including the net reserve release and an income tax benefit, were $9.6 billion.”

Dimon continued: “In Consumer & Community Banking, combined debit and credit card spend was up 26%, and Card payment rates have stabilized contributing to modest Card loan growth. Originations in Home Lending remain strong, up 43% to $42 billion, and remain at historically high levels in Auto, of over $11 billion. However, CCB loans were down 2% reflecting continued elevated prepayments in mortgage and the impact of PPP forgiveness primarily offset by growth in Auto, up 12%, and Card, up 1%. In the Corporate & Investment Bank, Global IB fees were up 52% driven by a surge in M&A activity and our strong performance in IPOs. Markets revenue was very strong overall and down just 5% compared to a third quarter record last year, as continued normalization in Fixed Income offset a strong performance in Equities. Commercial Banking earned a record $1.3 billion of gross IB revenue reflecting the strength of the M&A market. CB loans were down 7%, however, we are seeing early signs of Commercial Real Estate loan growth on modestly higher new loan originations in Commercial Term Lending. In Asset & Wealth Management, AUM of $3.0 trillion grew 17% driven by higher asset values and strong net inflows, and loans continue to be strong, up 20% primarily driven by securities-based lending.”

Dimon concluded: “We are making important investments, including strategic, add-on acquisitions that will drive our firm’s future prospects and position it to grow and prosper for decades. This quarter, we became the first bank to have branches in all of the lower 48 states, allowing us to serve more households, businesses and communities across the country. We are more than halfway through our plan to open 400 branches in new markets by the end of 2022, with approximately 30% of these branches in lowto-moderate income communities. We are also expanding our retail presence internationally, most recently launching our digital retail bank in the U.K. We remain committed to using our resources to drive inclusive solutions to support our employees, customers, clients and the communities we serve.”

Jamie Dimon. Foto: Steve Jurvetson Creative Commons Attribution 2.0

Kommentare lesen und schreiben, hier klicken