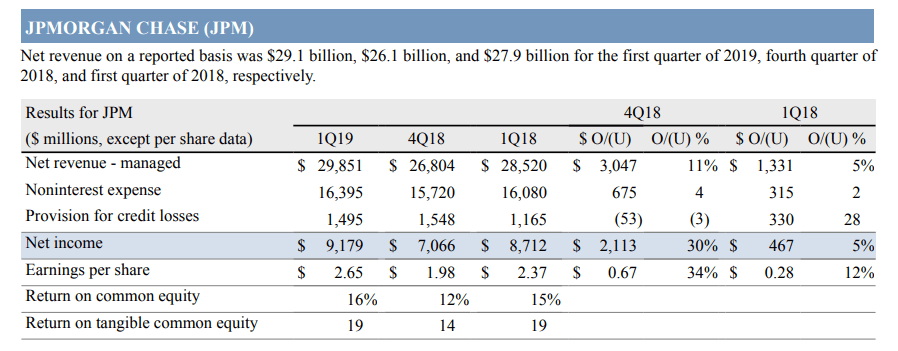

Die Quartalssaison in den USA ist eröffnet. Und gleich zu Anfang wie immer das Schwergwicht im US-Finanzsektor. Die Nummer 1 meldet zuerst. Die JP Morgan-Quartalszahlen sind soeben veröffentlicht worden. Hier die wichtigsten Kennzahlen.

Der Umsatz liegt bei 29,85 Milliarden Dollar (Vorjahresquartal 27,9/erwartet 28,3).

Der Umsatz im Segment „Anleihen, Devisen und Rohstoffe“ liegt bei 3,73 Milliarden Dollar (erwartet 3,7).

Der Gewinn liegt bei 2,65 Dollar pro Aktie (Vorjahresquartal 2,37/erwartet 2,32).

Die Aktie notiert vorbörslich mit 2,2% im Plus.

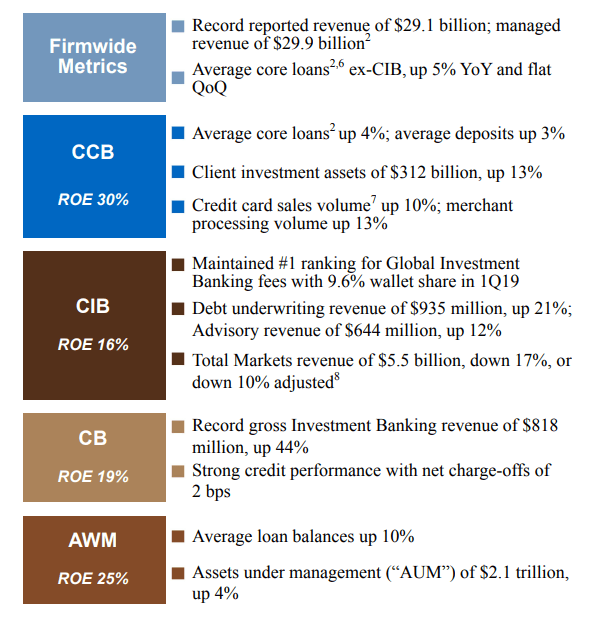

Jamie Dimon im aktuellen Wortlaut zu den Zahlen:

Jamie Dimon, Chairman and CEO, commented on the financial results: “In the first quarter of 2019, we had record revenue and net income, strong performance across each of our major businesses and a more constructive environment. Even amid some global geopolitical uncertainty, the U.S. economy continues to grow, employment and wages are going up, inflation is moderate, financial markets are healthy and consumer and business confidence remains strong.”

Dimon added: “In Consumer & Community Banking, client investment assets topped $300 billion, with record new money driven by our physical and digital channels. Consumer spending remains robust with credit card sales and merchant processing volume up double digits. We continued to execute on our expansion plans, announcing 90 branches this year in new markets, and creating tremendous opportunities for each of our businesses to better serve our clients. Investment Banking results were strong – particularly in debt underwriting and advisory – as the Firm maintained its #1 rank in Global IB fees and Commercial Banking generated record gross IB revenue. As the environment stabilized, the Markets business performed solidly, although down from a particularly strong prior-year quarter. And Asset & Wealth Management grew AUM 4% with continued net longterm inflows.”

Dimon concluded: “JPMorgan Chase will continue to use its capital, people and expertise to drive great outcomes for our communities. This quarter alone, we announced two important programs that we believe will make a difference in the long run – first, a $350 million New Skills at Work commitment focused on preparing people to succeed in our transformed workplaces and in the changing global economy. And second, Advancing Black Pathways, which expands existing Firm commitments to help create economic opportunity for more black families, students, businesses, employees and communities, with the ultimate goal of bridging the racial wealth divide and making the Firm and the country better. Businesses, governments and communities need to work as partners and solve problems that help strengthen the economy for everyone’s benefit. We are dedicated to doing our part.

Karrikatur von Jamie Dimon, dem „USA-Banker“, dem Chef der wichtigsten und mächtigsten Bank der USA, der JP Morgan zu einer sprudelnden Geldquelle machte. Urheber: DonkeyHotey CC BY-SA 2.0

Kommentare lesen und schreiben, hier klicken