FMW-Redaktion

Die Netflix-Quartalszahlen wurden soeben veröffentlicht. Hier die wichtigsten Kennzahlen.

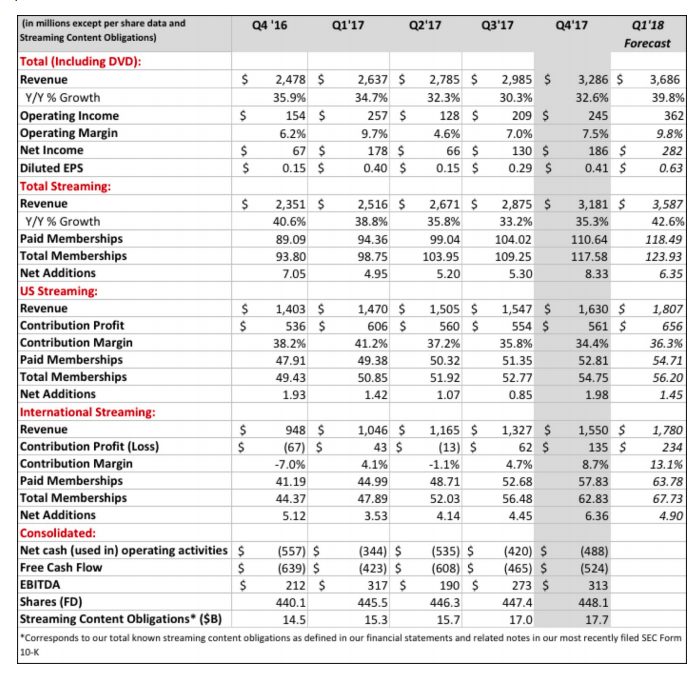

Der Umsatz liegt bei 3,29 Milliarden Dollar (Vorjahresquartal 2,48/erwartet 3,3).

Der Gewinn liegt bei 0,41 Dollar pro Aktie (Vorjahresquartal 0,15/erwartet 0,41). Pflüsterschätzungen lagen bei 0,43 Dollar.

Für das laufende Quartal rechnet man jetzt mit 0,63 Dollar Gewinn pro Aktie.

Mit 35,3% Wachstumsrate bei den Neukunden bleibt man konstant hoch!

Im 4. Quartal 8,33 Millionen neue Kunden, netto! (erwartet +6 Mio).

Ausblick für das laufende Quartal: Erwartung von Netflix selbst +6,35 Mio neue Abos (Markterwartungen bislang +5).

Die Aktie notiert nachbörslich mit +12%.

Details im Wortlaut von Netflix:

Average paid streaming memberships rose 25% year over year in Q4. Combined with a 9% increase in ASP, global streaming revenue growth amounted to 35%. Operating income of $245 million (7.5% margin) vs. $154 million prior year (6.2% margin) was slightly above our $238 million forecast.

Operating margin for FY17 was 7.2%, on target with our goal at the beginning of this year. EPS was $0.41 vs. $0.15 last year and met our forecast of $0.41. There were several below the line items that affected net income, including a pre-tax $26 million non-cash unrealized loss from F/X remeasurement on our Eurobond. Our tax rate was helped by a $66 million foreign tax benefit, which partially offset a revaluation of our deferred tax assets and the impact from the mandatory deemed repatriation of accumulated foreign earnings related to the recent US tax reform.

In Q4, we registered global net adds of 8.3 million, the highest quarter in our history and up 18% vs. last year’s record 7.05 million net adds. This exceeded our 6.3m forecast due primarily to stronger than expected acquisition fueled by our original content slate and the ongoing global adoption of internet entertainment. Geographically, the outperformance vs. guidance was broad-based.

In the US, memberships rose by 2.0 million (vs. forecast of 1.25m) bringing total FY17 net adds to 5.3 million. ASP rose 5% year-over-year. Domestic contribution profit increased 5% year-over-year although contribution margin of 34.4% declined both on a year-over-year and sequential basis due to the marketing spend we noted in last quarter’s investor letter.

Internationally, we added 6.36 million memberships (compared with guidance of 5.05m), a new record for quarterly net adds for this segment. Excluding a F/X impact of +$43 million, international revenue and ASP grew 59% and 12% year over year, respectively. The increase in ASP reflects price adjustments in a wide variety of our markets over the course of 2017. With contribution profit of $227 million in 2017 (4.5% contribution margin), the international segment delivered its first full year of positive contribution profit in our history.

We took a $39m non-cash charge in Q4 for unreleased content we’ve decided not to move forward with. This charge was recognized in content expense in cost of revenues. Despite this unexpected expense, we slightly exceeded our contribution profit and operating income forecast due to our stronger than expected member growth and the timing of international content spend.

Ausblick:

The guidance we provide is our internal forecast at the time we report. For Q1, we project global net adds of 6.35 million (vs. 5.0m in the year ago quarter), with 1.45m in the US and 4.90m internationally. As we wrote last quarter, our primary profit metric is operating margin and we are targeting a full year 2018 target of 10%, up about 300 basis points year over year, as in the prior year. We believe our big investments in content are paying off. In 2017, average streaming hours per membership grew by 9% year-over-year. With greater than expected member growth (resulting in more revenue), we now plan to spend $7.5-$8.0 billion on content on a P&L basis in 2018.

Kommentare lesen und schreiben, hier klicken