FMW-Redaktion

Die russische Zentralbank hat soeben ihren Leitzins von 9,75% auf 9,25% gesenkt. Erwartet worden waren nur 0,25% Senkung auf 9,50%. Somit war auch nur diese Marke im Rubel-Kurs eingepreist. Liest man dazu die aktuelle Mittelung der Zentralbank, dann denkt man die wirtschaftliche Lage in Russland sieht doch ganz gut aus. Das Inflationsziel von 4% (von oben nach unten Richtung 4%) werde wohl noch vor Ende des Jahres erreicht werden. Die wirtschaftliche Aktivität nehme deutlich zu.

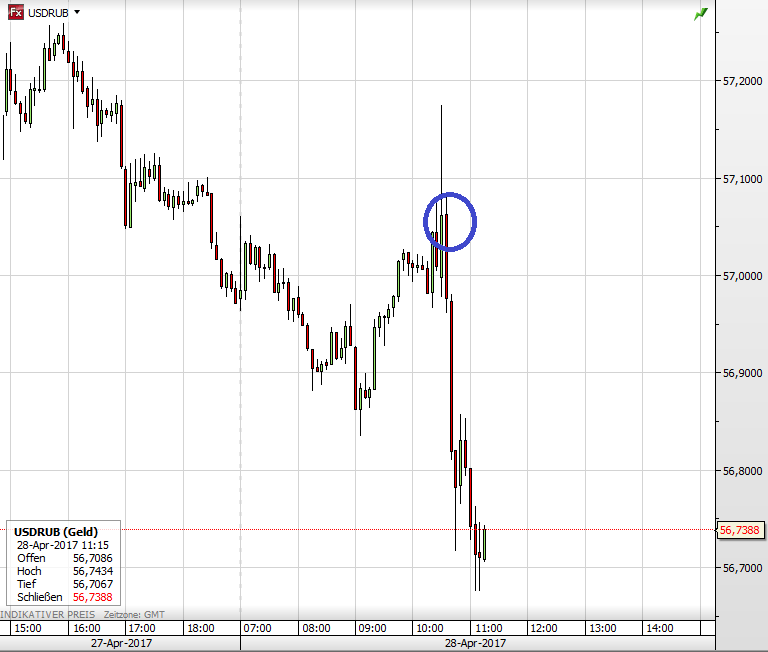

Erstaunlich reagiert aktuell der russische Rubel. Da der Leitzins doppelt so stark gesenkt wurde wie erwartet, hätte dies eigentlich eine Schwächung des Rubel zur Folge. Im Währungspaar US-Dollar vs Russischer Rubel (USDRUB) wird aber aktuell der Dollar etwas schwächer. Das widerspricht dem lehrbuchmäßigen Verlauf der Geldflüsse, wonach sinkende Zinsen einen Währungsraum weniger attraktiv machen, Geld fließt ab, und damit wertet die Währung ab. So einen Vorgang preisen die Devisenhändler normalerweise sofort nach einer Notenbank-Entscheidung in die Kurse ein.

Aber wie man sieht: USDRUB fällt seit der Entscheidung von 57 auf 56,72. Für wenige Augenblicke hatten wohl die ALGOS (Computerprogramme) den Kurs in die lehrbuchmäßig richtige Richtung gedrückt. Aber der Rubel wertet bis jetzt sogar leicht auf (sinkender Dollar).

Auszugsweise vom aktuellen Text der Zentralbank im Wortlaut:

Inflation dynamics. Annual inflation has moved close to the target level. Annual consumer price growth is down to 4.3% from 4.6% in February. According to the estimates as of 24 April, annual inflation stands at 4.2-4.3%. March saw a slowdown in price growth across all core groups of goods and services. Inflation slowdown was broadly facilitated by the ruble appreciation amid relatively higher oil prices, persistent interest in investment in Russian assets among external investors, and a drop in the sovereign risk premium. Seasonally adjusted monthly inflation data in February and March held at a low level. These months saw food inflation unusually low for this period, supported by the high level of supply including bumper harvests of 2015-2016. This impact is likely to run its course in the second quarter, which is attested by weekly price growth data for April that suggests that prices on fruit and vegetables accelerated. Even so, inflation is estimated to remain on the path of downward movement towards the 4% target before the end of 2017.

As inflation showed a substantial slowdown in 2017 Q1, inflation expectations of both households and businesses were down considerably. However, this trend may grind to a halt temporarily as food inflation is expected to post a seasonal increase, considering that inflation expectations are sensitive to the dynamics of this inflation.

Domestic demand continues to exert a disinflationary effect. Households broadly tend to demonstrate savings behaviour patterns. There are signs of nascent recovery in consumer activity. Consumer expenditures are expected to restore gradually as real disposable incomes continue to show weak growth. Consumer lending bears no inflation risks.

Economic activity. The Bank of Russia estimates that the economy continued to recover in the first quarter and expects fixed capital investments to increase. Industrial production is maintaining positive dynamics and unemployment is showing a downward trend. The labour market is adjusting to the new economic environment, with signs beginning to emerge that labour shortages are finding their way in individual segments. Recovery is becoming more even across regions. Polling data reflects an improvement in business and household sentiments, supporting favourable economic dynamics. According to the Bank of Russia estimates, the observed annual rise in real wages will foster gradual growth in consumer activity without posing additional proinflationary pressure amid increased supply of goods and services.

Given the current recovery dynamics and the economy’s growing resilience to the fluctuations in the external economic climate, the Bank of Russia expects that the GDP will grow in 2017-2019 even if the conservative oil price scenario materialises.

Inflation risks. Possible volatility of global commodity and financial markets caused, among other things, by negotiations between oil exporting countries to extend agreements on limiting oil production may become the key source of inflation risks in the near future. It may result in a temporary hike in volatility of capital flows and the exchange rate undermining exchange rate and inflation expectations. That said, inflation risks will be lower in the scenario with rising oil prices. Legislative consolidation of a budget rule will also mitigate medium-term inflation risks.

Besides, medium-term inflation risks are that anchoring of inflation and inflation expectations at the target level may take a long time. This is caused by the inertia of inflation expectations and a possible shift in households’ behaviour pattern due to a decline in propensity to save.

In making its decision on the key rate, the Bank of Russia will assess the probability of the baseline scenario implementation (where oil prices drop to $40 per barrel) and the scenario with rising oil prices, alongside with assessing inflation and the economy dynamics relative to the forecast. The Bank of Russia’s assessment of the overall potential of the key rate reduction before the end of 2017 is unchanged. Given the decision taken and moderately tight monetary policy sustained, the Bank of Russia forecasts that the annual consumer price growth will reduce to 4% before the end of 2017 and will remain within this target level in 2018-2019.

The Bank of Russia Board of Directors will hold its next rate review meeting on 16 June 2017. The press release on the Bank of Russia Board’s decision is to be published at 13:30 Moscow time.

Kommentare lesen und schreiben, hier klicken