Twitter hat heute Nacht seine Quartalszahlen veröffentlicht. Hier die wichtigsten Kennzahlen.

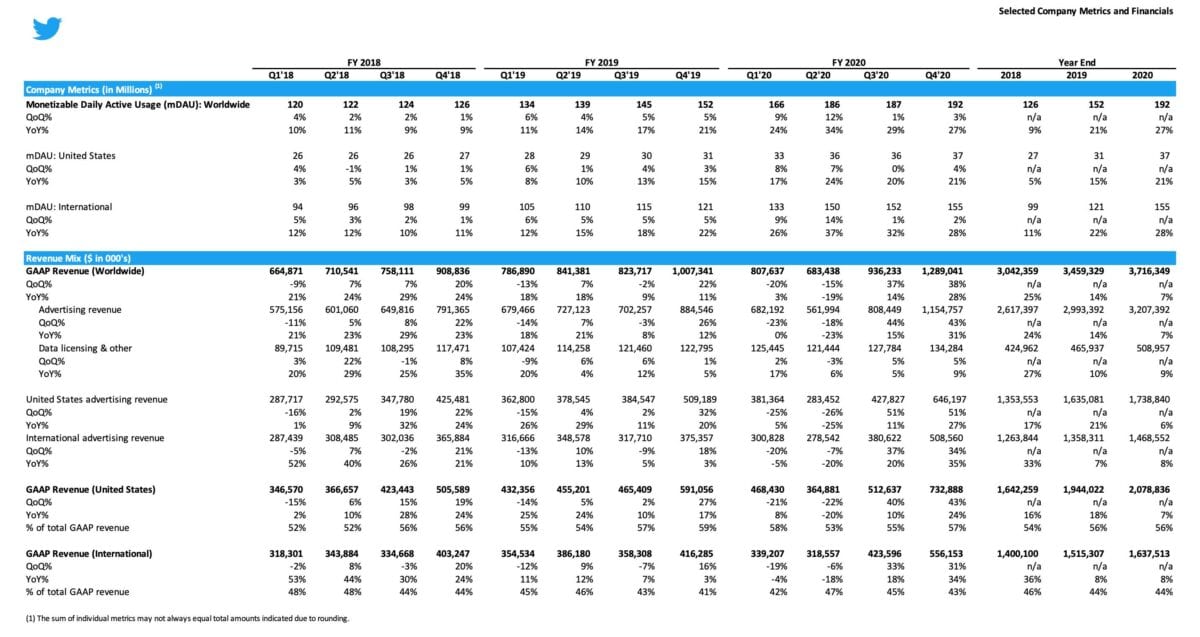

Der Umsatz lag bei 1,29 Milliarden Dollar (Vorjahresquartal 1,01 Milliarden/erwartet 1,19).

Der Gewinn nach Non-GAAP (bereinigt) lag bei 0,38Dollar pro Aktie (Vorjahresquartal 0,25/erwartet 0,31).

Die Aktie von Twitter notierte nachbörslich mit +3,4 Prozent.

Die Zahl der täglich aktiven Nutzer (die auch monetarisierbar sind) liegt bei 192 Millionen (vor einem Jahr 152, für heute erwartet 193,5).

Der Umsatz im aktuell laufenden 1. Quartal soll zwischen 0,94 und 1,04 Milliarden Dollar liegen, so Twitter heute Nacht. Bisherige Erwartungen lagen am unteren Ende dieser Spanne.

Headline-Zitat von Twitter:

“2020 was an extraordinary year for Twitter. We are more proud than ever to serve the public conversation, especially in these unprecedented times,” said Jack Dorsey, Twitter’s CEO. “We reported a 27% year-over-year increase in mDAU in Q4 2020, reaching an average of 192 million. Our product changes to date are promoting healthier conversations for those who use our service, including advertisers and partners, and we are excited about our plans to continue innovating in 2021.”

“We delivered record revenue of $1.29 billion in Q4, up 28% year over year, reflecting better-than-expected performance across all major products and geographies,” said Ned Segal, Twitter’s CFO. “We made significant progress on our brand and direct response products in advance of the recent relaunch of our Mobile Application Promotion (MAP) offering. Advertisers are benefitting from new ad formats, stronger attribution, and improved targeting, resulting in a 31% year-over-year increase in total ad revenue and greater than 50% year-over-year growth in MAP revenue in Q4.”

Ausblick im Wortlaut:

We expect to grow headcount by more than 20% in 2021, especially in engineering, product, design, and research. Given the hiring and investment decisions made in 2020 and previous years, along with anticipated 2021 headcount growth, we expect total costs and expenses to grow 25% or more in 2021, ramping in absolute dollars over the course of the year. Our investments also include the final buildout of a new data center in 2021, adding capacity to support audience and revenue growth.

Finally, assuming the global pandemic continues to improve and that we see modest impact from the rollout of changes associated with iOS 14, we expect total revenue to grow faster than expenses in 2021. How much faster will depend on our execution on our direct response roadmap and macroeconomic factors.

For Q1’21, we expect:

• Total revenue to be between $940 million and $1.04 billion

• GAAP operating income to be between a loss of $50 million and break even

For FY21, we expect:

• Stock-based compensation expense to be between $525 million and $575 million

• Capital expenditures to be between $900 million and $950 million

Kommentare lesen und schreiben, hier klicken