Die US-Erstanträge für Arbeitslosenhilfe sind mit 245.000 höher ausgefallen als erwartet (Prognose war 240.000; Vorwoche war 239.000).

Die Folgeanträge liegen mit 1,865 Millionen höher als erwartet (Prognose war 1,820 Millionen, Vorwoche war 1,810 Millionen).

—–

Der Philadelphia Fed Index (April) ist mit -31,3 noch schwächer ausgefallen als erwartet (Prognose war -19,2; Vormonat war -23,2).

Die Komponenten:

Beschäftigung: -0,5 (Vormonat war -10,3)

Neue Aufträge: -22,6 (Vormonat war -21,2)

Preise: +8,“ (Vormonat war +23,5)

Dazu schreibt die Fed von Philadelphia:

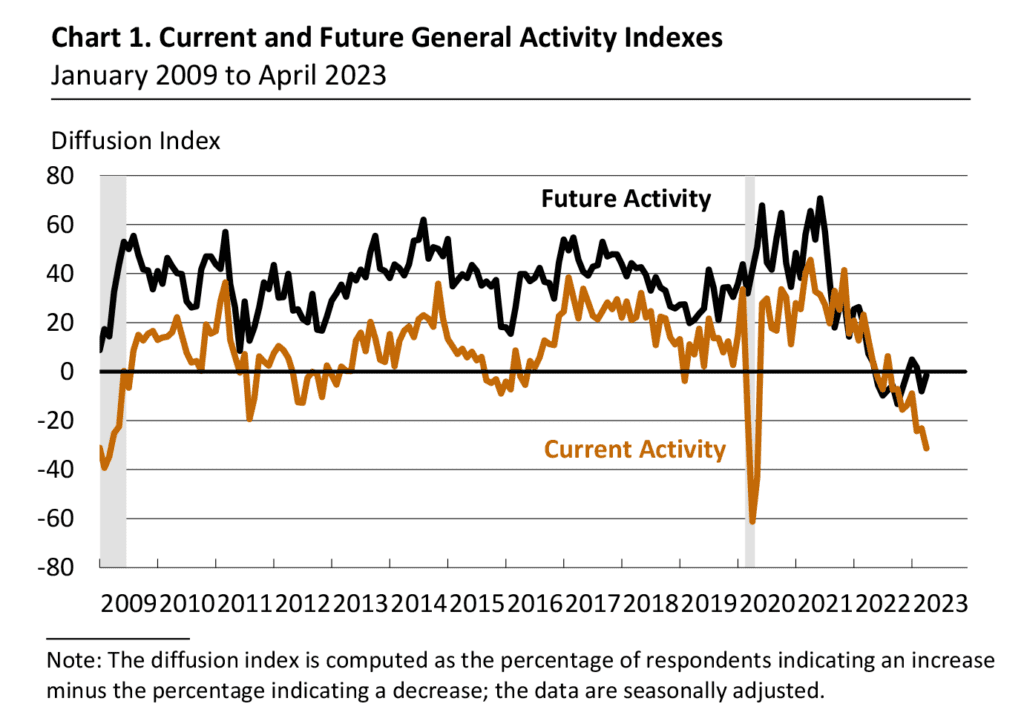

Manufacturing activity in the region continued to decline overall in April, according to the firms responding to this month’s Manufacturing Business Outlook Survey. The survey’s broad indicators for activity remained negative, although the indexes for new orders and shipments rose. The employment index suggests steady employment overall. Both price indexes continued to decline. The future indicators suggest that firms’ expectations for growth over the next six months remain subdued.

Current Indicators Remain Negative

The diffusion index for current general activity decreased 8 points to -31.3 in April, its eighth consecutive negative reading and lowest reading since May 2020 (see Chart 1). Although most firms reported no change in activity (59 percent), the share of firms reporting decreases (35 percent) exceeded the share of firms reporting increases (3 percent). The indexes for new orders and shipments both remained negative but increased this month: The new orders index rose 6 points to -22.7, and the shipments index climbed 18 points to -7.3. Almost 28 percent of the firms reported decreases in shipments (down from 31 percent last month) compared with 20 percent that reported increases (up from 6 percent last month).

On balance, the firms reported mostly steady levels of employment. The employment index rose 10 points to a near-zero reading. Similar shares of the firms reported increases and decreases in employment (16 percent); most firms (67 percent) reported no change. The average workweek index rose from -22.0 to -8.4.

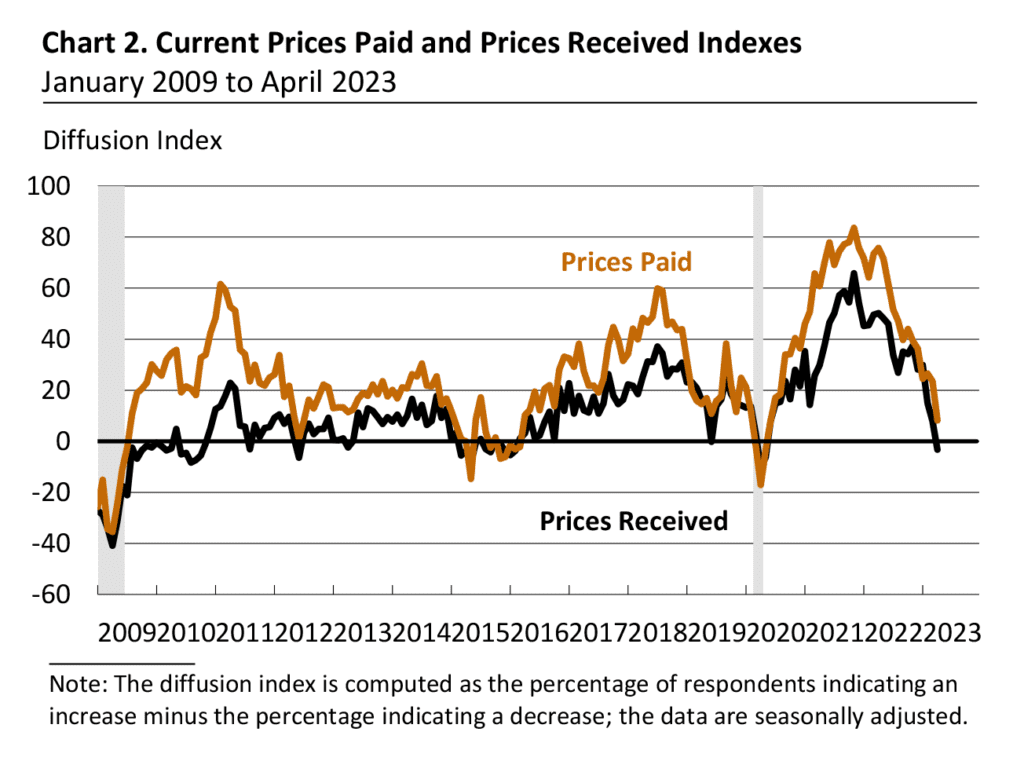

Price Increases Are Less Widespread

The indicators for prices paid and prices received declined to their lowest readings since mid-2020. The prices paid index declined for the second consecutive month, falling 15 points to 8.2 (see Chart 2). Almost 19 percent of the firms reported increases in input prices, while 10 percent reported decreases; 70 percent of the firms reported no change. The current prices received index fell 11 points to -3.3, its third consecutive decline and first negative reading since May 2020. Over 7 percent of the firms reported increases in prices received for their own goods this month, 10 percent reported decreases, and 83 percent reported no change.

Kommentare lesen und schreiben, hier klicken