Die Wells Fargo-Quartalszahlen sind soeben veröffentlicht worden. Man gehört zu den fünf großen US-Banken. Hier die wichtigsten Kennzahlen.

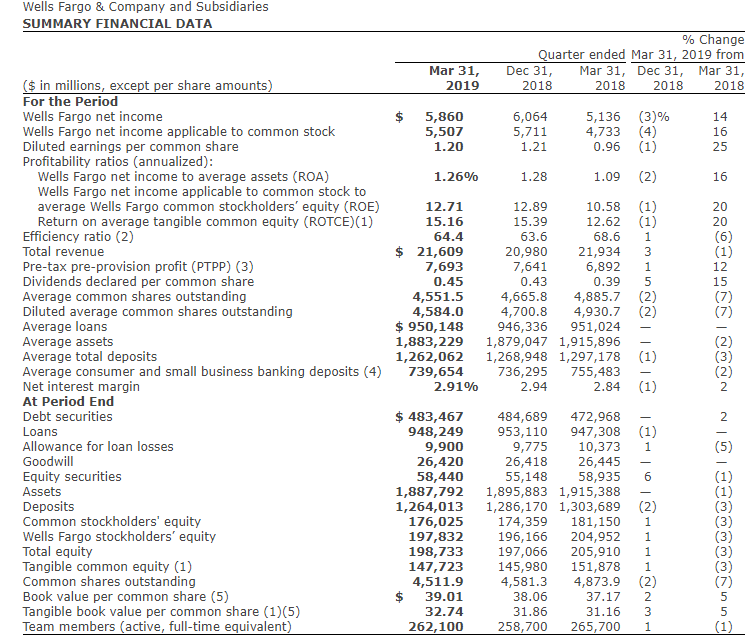

Der Umsatz liegt bei 21,6 Milliarden Dollar (Vorjahresquartal 21,93/erwartet 20,9). Also ist der Umsatz leicht schlechter als vor einem Jahr, aber eben besser als erwartet.

Der Gewinn liegt bei 1,20 Dollar pro Aktie (Vorjahresquartal 1,12/erwartet 1,08).

Kreditvolumen rückläufig um knapp 1%, Einlagenvolumen +3%.

Die Aktie notiert vorbörslich mit +2%.

Wells Fargo zu den aktuellen Zahlen im Wortlaut:

Interim Chief Executive Officer Allen Parker said, “Since assuming this role, I have been focused on leading our Company forward by emphasizing my top priorities: serving our customers and supporting our Wells Fargo team members; meeting and exceeding the expectations of our regulators; and continuing the important transformation of the Company. We have more work ahead of us, and our strong leadership team is dedicated to making our Company the most customer-focused, efficient, and innovative Wells Fargo ever. All these efforts are focused on creating a first-rate organization that is characterized by a strong financial foundation, a leading presence in our chosen markets, focused growth within a responsible risk management framework, operational excellence, and highly engaged team members. I want to thank our team members for their continued commitment and tireless efforts, and I’m confident and enthusiastic about the extraordinary opportunities we have in front of us to build an even stronger Wells Fargo for all our stakeholders.”

Chief Financial Officer John Shrewsberry said, “Wells Fargo reported $5.9 billion of net income in the first quarter. Our financial results included continued strong credit performance and high levels of liquidity. In addition, our continued de-risking of the balance sheet and consistent level of profitability have resulted in capital levels well above our regulatory minimum. As a result, we returned $6.0 billion to shareholders through common stock dividends and net share repurchases in the first quarter, up 49% from a year ago. Returning excess capital to shareholders remains a priority. While our expenses in the first quarter included typically higher personnel expense, we remain committed to, and are on track to achieving, our 2019 expense target.”

Foto: Gabriel Vanslette CC BY 3.0

Kommentare lesen und schreiben, hier klicken