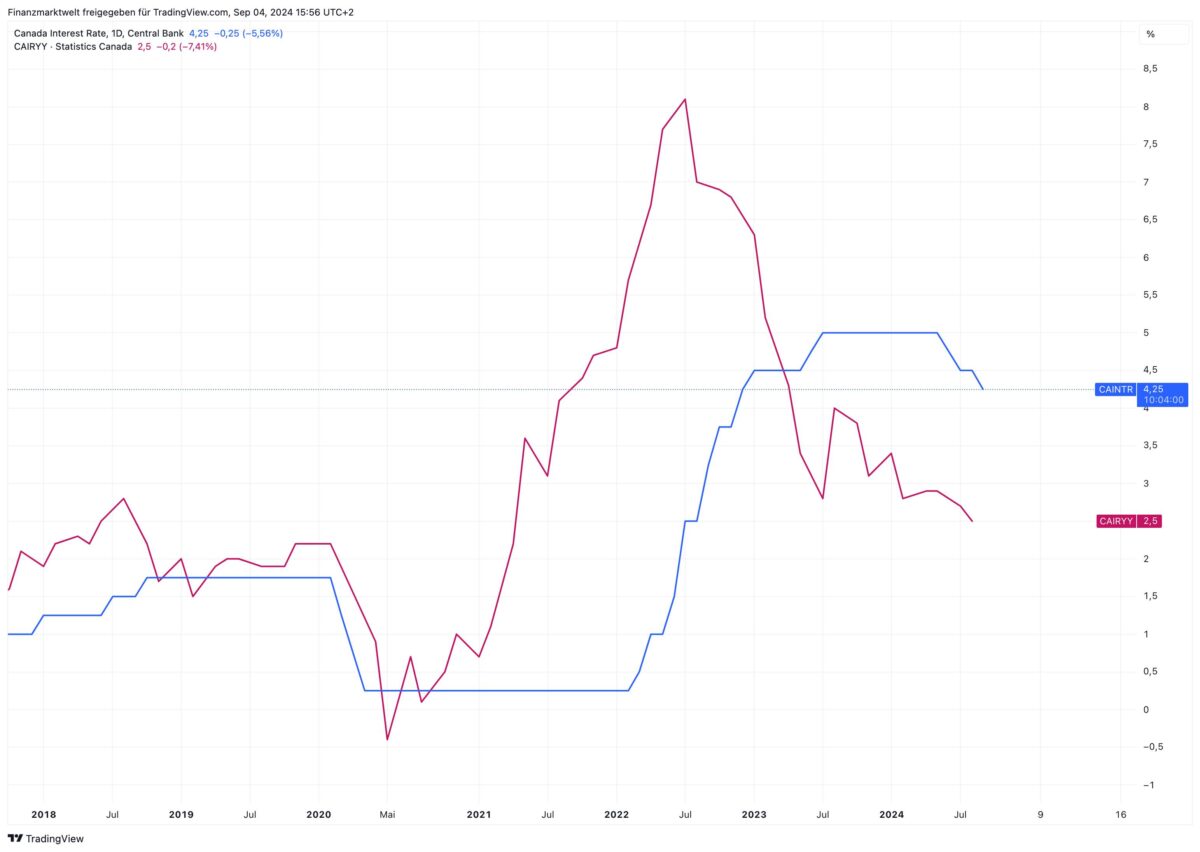

Die EZB hat bereits am 6. Juni gesenkt und wird wohl nächste Woche erneut senken. Die Fed wird wohl am 18. September Zinsen senken. Die Bank of Canada hat vor wenigen Minuten ihren Leitzins gesenkt von 4,5 % auf 4,25 %. In wenigen Monaten ist dies die dritte Zinssenkung in Kanada um je 25 Basispunkte. Noch im Mai lag der Leitzins bei 5,0 %. Der Chart zeigt seit 2018 den Leitzins in blau, die Inflation in rot. Die Inflation ist bereits von 8 % auf 2,5 % zurückgekommen.

Hier dazu das aktuelle Statement der Bank of Canada: The global economy expanded by about 2½% in the second quarter, consistent with projections in the Bank’s July Monetary Policy Report (MPR). In the United States, economic growth was stronger than expected, led by consumption, but the labour market has slowed. Euro-area growth has been boosted by tourism and other services, while manufacturing has been soft. Inflation in both regions continues to moderate. In China, weak domestic demand weighed on economic growth. Global financial conditions have eased further since July, with declines in bond yields. The Canadian dollar has appreciated modestly, largely reflecting a lower US dollar. Oil prices are lower than assumed in the July MPR.

In Canada, the economy grew by 2.1% in the second quarter, led by government spending and business investment. This was slightly stronger than forecast in July, but preliminary indicators suggest that economic activity was soft through June and July. The labour market continues to slow, with little change in employment in recent months. Wage growth, however, remains elevated relative to productivity.

As expected, inflation slowed further to 2.5% in July. The Bank’s preferred measures of core inflation averaged around 2 ½% and the share of components of the consumer price index growing above 3% is roughly at its historical norm. High shelter price inflation is still the biggest contributor to total inflation but is starting to slow. Inflation also remains elevated in some other services.

With continued easing in broad inflationary pressures, Governing Council decided to reduce the policy interest rate by a further 25 basis points. Excess supply in the economy continues to put downward pressure on inflation, while price increases in shelter and some other services are holding inflation up. Governing Council is carefully assessing these opposing forces on inflation. Monetary policy decisions will be guided by incoming information and our assessment of their implications for the inflation outlook. The Bank remains resolute in its commitment to restoring price stability for Canadians.

Kommentare lesen und schreiben, hier klicken