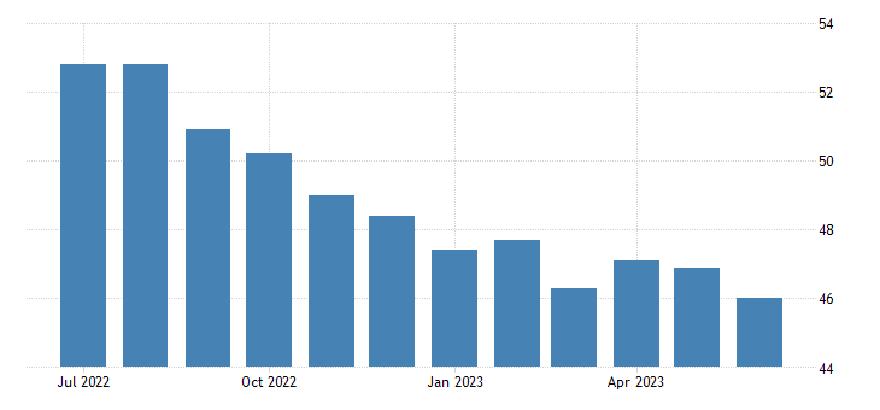

Neue Zahlen zur Wirtschaft der USA: Der ISM Index (Gewerbe; Juni) ist mit 46,0 Punkten schwächer ausgefallen als erwartet (Prognose war 47,2; Vormonat war 46,9). Das ist der achte Monat in Folge mit Schrumpfung (alle Werte unter 50 bedeuten Kontraktion). Das ist der schwächste Wert seit drei Jahren!

Die Komponenten:

– Beschäftigung 48,1 (Vormonat war 51,4)

– Neuaufträge 45,6 (Vormonat war 42,6)

– Preise 41,8 (Vormonat war 44,2, heute erwartet war 44,0 – alle Werte unter 50 bedeuten fallende Preise!)

Marktreaktion: US-Aktienmärkte wenig verändert, Dollar etwas schwächer, US-Renditen fallen..

Grafik: Tradingeconomics

Dazu schreibt ISM:

“The U.S. manufacturing sector shrank again, with the Manufacturing PMI® losing ground compared to the previous month, indicating a faster rate of contraction. The June composite index reading reflects companies continuing to manage outputs down as softness continues and optimism about the second half of 2023 weakens. Demand eased again, with the (1) New Orders Index contracting but at a slower rate, (2) New Export Orders Index moving into contraction and (3) Backlog of Orders Index remaining at a level not seen since early in the coronavirus pandemic (May 2020). A potential bright spot: The Customers’ Inventories Index dropped into ‘too low’ territory, a positive for future production. Output/Consumption (measured by the Production and Employment indexes) was negative, with a combined 7.7-percentage point downward impact on the Manufacturing PMI® calculation. Panelists’ companies reduced production and began using layoffs to manage head counts, to a greater extent than in prior months, amid mixed sentiment about when significant growth will return. Inputs — defined as supplier deliveries, inventories, prices and imports — continue to accommodate future demand growth. The Supplier Deliveries Index continued to indicate faster deliveries, and the Inventories Index dropped further into contraction as panelists’ companies try to mitigate inventories exposure. The Prices Index fell further into ‘decreasing’ territory. Manufacturing lead times improved again but remain at elevated levels.

“Of the six biggest manufacturing industries, only one — Transportation Equipment — registered growth in June.

“Demand remains weak, production is slowing due to lack of work, and suppliers have capacity. There are signs of more employment reduction actions in the near term. Seventy-one percent of manufacturing gross domestic product (GDP) contracted in June, down from 76 percent in May. More industries contracted strongly, however, as the share of manufacturing GDP registering a composite PMI® calculation at or below 45 percent — a good barometer of overall manufacturing weakness — was 44 percent in June, compared to 31 percent in May,” says Fiore.

The four manufacturing industries that reported growth in June are: Printing & Related Support Activities; Nonmetallic Mineral Products; Primary Metals; and Transportation Equipment. The 11 industries reporting contraction in June, in the following order, are: Plastics & Rubber Products; Wood Products; Textile Mills; Chemical Products; Miscellaneous Manufacturing; Electrical Equipment, Appliances & Components; Computer & Electronic Products; Paper Products; Fabricated Metal Products; Food, Beverage & Tobacco Products; and Machinery.

Kommentare lesen und schreiben, hier klicken