FMW-Redaktion

Die wichtigsten Aussagen aus dem Statement der Fed in Schlagzeilen.

Drei weitere Zinsanhebungen in 2018

Schnelleres Wachstum in 2018.

Niedrigere Arbeitslosigkeit in 2018.

Zwei FOMC-Mitglieder widersprachen der heutigen Zinsanhebung (Evans und Kashkari).

UPDATE 20:15 Uhr

25 Basispunkte-Erhöhung im Juni schon jetzt erwartet.

Inflation (exklusive Energie und Lebensmittel) sind in 2017 unter 2% gelaufen.

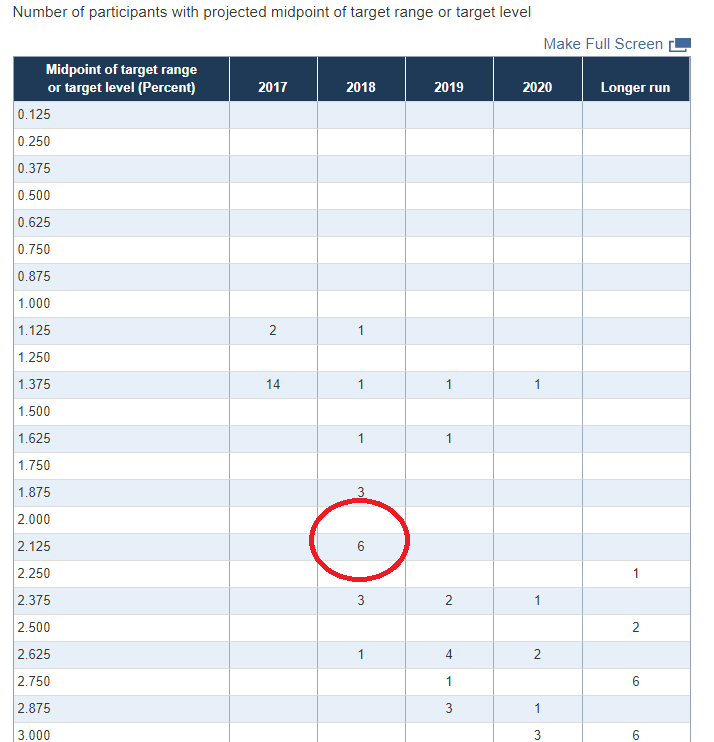

Diese Grafik von heute zeigt: Die Erwartungen der meisten Fed-Mitglieder für 2018 liegen bei 2,1%.

UPDATE 20:28 Uhr

Diese Grafik zeigt: In Sachen Inflationserwartung und Leitzins für 2017 und 2018 hat sich beim FOMC nichts geändert (rot umrandet).

Zum Vergrößern bitte anklicken.

Fed statement redline comparison pic.twitter.com/NaHug8LXHQ

— zerohedge (@zerohedge) December 13, 2017

Hier das Statement im Wortlaut:

Information received since the Federal Open Market Committee met in November indicates that the labor market has continued to strengthen and that economic activity has been rising at a solid rate. Averaging through hurricane-related fluctuations, job gains have been solid, and the unemployment rate declined further. Household spending has been expanding at a moderate rate, and growth in business fixed investment has picked up in recent quarters. On a 12-month basis, both overall inflation and inflation for items other than food and energy have declined this year and are running below 2 percent. Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations are little changed, on balance.

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Hurricane-related disruptions and rebuilding have affected economic activity, employment, and inflation in recent months but have not materially altered the outlook for the national economy. Consequently, the Committee continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will remain strong. Inflation on a 12‑month basis is expected to remain somewhat below 2 percent in the near term but to stabilize around the Committee’s 2 percent objective over the medium term. Near-term risks to the economic outlook appear roughly balanced, but the Committee is monitoring inflation developments closely.

In view of realized and expected labor market conditions and inflation, the Committee decided to raise the target range for the federal funds rate to 1-1/4 to 1‑1/2 percent. The stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation.

In determining the timing and size of future adjustments to the target range for the federal funds rate, the Committee will assess realized and expected economic conditions relative to its objectives of maximum employment and 2 percent inflation. This assessment will take into account a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments. The Committee will carefully monitor actual and expected inflation developments relative to its symmetric inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.

Beispielbild einer Fed-Sitzung

Foto: Federal Reserve

Kommentare lesen und schreiben, hier klicken

Wie jetzt, nur noch drei Zinsanhebungen in 2018? Nicht mehr vier? Und weiterhin nur immer noch moderate 0.25 Punkte pro Schritt?

Die schon längst nicht mehr bestehende Arbeitslosigkeit wird sich noch weiter verbessern? Jeder Ami wird dann 5 Jobs pro Tag ausüben, vielleicht sogar 8, wenn Trump alle Menschen aus Mexiko und der Karibik eliminiert und neutralisiert hat?

Mr. Wonder wird’s schon richten ;)