Wie allgemein erwartet, beläßt die US-Notenbank Fed die Zinsen unverändert bei 5,25% bis 5,50% – das hatte die Fed bereits vor einigen Wochen klar an die Märkte signalisiert.

Hier die wichtigsten Passagen aus dem FOMC-Statement:

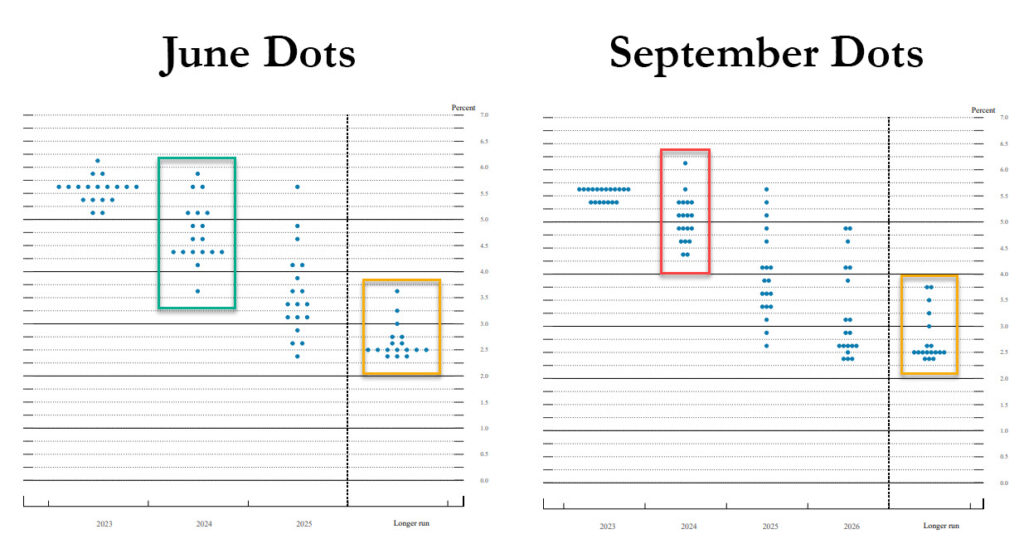

Dot Plots: FED ’23 MEDIAN RATE FORECAST STAYS AT 5.6%; ’24 RISES TO 5.1% FROM 4.6% (FMW: extrem hawkish!)

FED: 12 OFFICIALS SEE ONE MORE HIKE THIS YEAR, 7 SEE ON HOLD

FMW: die Fed erwarftet also einen weiteren Zinsschritt in 2023 und geht für 2024 davon aus, dass die Zinsen über der Marke von 5% bleiben wird! Das erwischt die Märkte auf dem falschen Fuß!

Hier die Dot Plots:

Das Statement der Fed im Wortlaut:

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have slowed in recent months but remain strong, and the unemployment rate has remained low. Inflation remains elevated.

The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Adriana D. Kugler; Lorie K. Logan; and Christopher J. Waller.

Kommentare lesen und schreiben, hier klicken

tja, ich erwarte ja >5,5%