Die JP Morgan-Quartalszahlen wurden soeben veröffentlicht. Sie genießen immense Bedeutung, da JP Morgan die größte Bank der USA ist. Hier die wichtigsten Eckdaten.

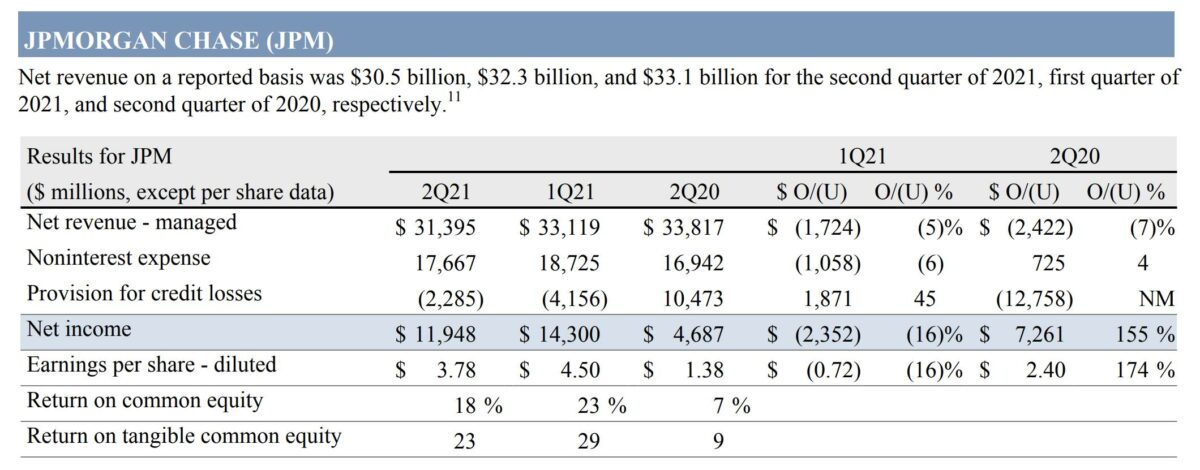

Der Erlös (Umsatz) liegt bei 31,4 Milliarden Dollar (Vorjahresquartal 33,8/für heute erwartet 30).

Der Gewinn pro Aktie liegt bei 3,78 Dollar pro Aktie (Vorjahresquartal 1,38/für heute erwartet 3,10).

Der Gewinn steht deswegen so gut da, weil JP Morgan Reserven aus Rückstellungen für mögliche Kreditausfälle auflösen konnte.

Die Aktie von JP Morgan notiert aktuell in der Vorbörse mit -1,1 Prozent.

Hier die ganze Headline-Aussage vom mächtigsten Banker der USA Jamie Dimon im Wortlaut:

JPMorgan Chase delivered solid performance across our businesses as we generated over $30 billion in revenue while continuing to make significant investments in technology, people and market expansion. This quarter we once again benefited from a significant reserve release as the environment continues to improve, but as we have said before, we do not consider these core or recurring profits. Our earnings, not including the reserve release, were $9.6 billion. Consumer and wholesale balance sheets remain exceptionally strong as the economic outlook continues to improve. In particular, net charge-offs, down 53%, were better than expected, reflecting the increasingly healthy condition of our customers and clients.”

Dimon continued: “In Consumer & Community Banking, combined debit and credit card spend was up 45%, or up 22% versus the more normal, pre-pandemic second quarter of 2019. We saw accelerating growth across categories including in travel and entertainment, which returned to growth in June, up 13% vs. 2019. Originations in Home Lending, up 64% to $40 billion, and Auto, up 61% to $12 billion, remained very strong. However, CCB loans were down 3% reflecting elevated prepayments in mortgage and lower Card balances. Deposits were up 25%, and investment assets were up 36%, driven by market appreciation and positive net flows. In the Corporate & Investment Bank, Global IB fees are at an all-time high of $3.6 billion, up 25%, driven by an active M&A market as well as acquisition financing in DCM. Markets revenue, down 30% compared to a record last year, was up 25% versus 2019 on strong client activity. Similarly, Commercial Banking earned gross IB revenue of $1.2 billion, up 37%. In Asset & Wealth Management, AUM of $3 trillion grew 21% driven by higher asset values and strong net inflows, and loans were up 21% primarily driven by securities-based lending.”

Dimon continued: “We are constantly investing, innovating and making strategic, addon acquisitions to better serve our employees, customers and communities. In the first half of 2021, we extended credit and raised $1.7 trillion in capital for businesses, institutional clients, and U.S. customers. We are executing on our commitments to advance economic opportunity and racial equity and launched a new initiative focused on improving healthcare for our employees and the communities we serve.”

Dimon concluded: “Our longstanding capital hierarchy remains the same – first and foremost, to invest in and grow our market-leading businesses to support our clients, customers and communities – even in the most difficult of times, second, to pay a sustainable dividend which we have already announced we are increasing, and third, to return any remaining excess capital to shareholders through share buybacks which we plan to continue under our existing authorization.”

Kommentare lesen und schreiben, hier klicken